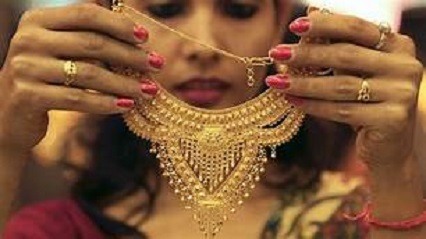

Gold dealers have been forced to offer discounts over official prices amid subdued physical demand in India

Dealer discounts on gold in India remained near one-month highs amid subdued retail demand. Discounts up to $6 an ounce over official domestic prices were offered during last week, compared to the previous week's discount of $5, according to a Reuters report. On MCX, gold rates had settled at ₹47,526 per gram on Friday while silver at ₹67,050 per kg. Gold rates in India include 10.75% import duty and 3% GST.

Though lockdown restrictions are getting gradually removed, price volatility in the precious metal is putting off retail investors, said a gold dealer. On July 15th, gold had risen to one-month high of ₹48,500 in the futures market.

In global markets, gold struggled last week amid a stronger US dollar and rebound in global risk appetite.

In global markets, gold rates ended the week at near $1,800 per ounce as fears over rising Delta variant COVID-19 cases eased, prompting investors to move out of the safe-haven asset as risk appetite returned.

Firmer US benchmark Treasury yields and a stronger US dollar, which remained over 3-month high, put pressure on gold. Higher yields tend to weigh on gold which pays no interest as it translates into an increased opportunity cost of holding the metal.

On gold traders' radar this week will be the outcome of US Federal Reserve meeting after the European Central Bank on Thursday pledged to keep interest rates at record lows for some time.

Analysts say that though coronavirus risks, inflation concerns and mixed economic numbers are keeping gold supported at lower levels, ETF investors continue to remain on sidelines awaiting fresh cues.

ETF flows into gold also remained weak. Holdings in New York's SPDR Gold Trust, the largest gold-backed exchange-traded-fund (ETF), were at their lowest in over two months on Thursday.

Be the first to comment