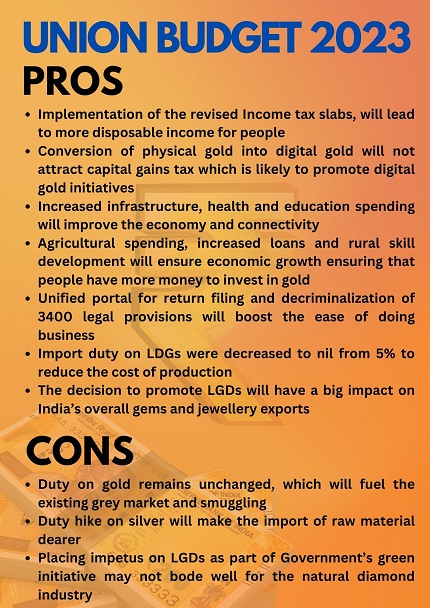

One of the biggest demands of the gems and jewellery sector was for the government to bring down the customs duty on gold to 10 per cent to eliminate smuggling – but the demand went unheard yet again

The Indian gems and jewellery industry which contributes around 7% to the country’s overall GDP employs over 5 million people. The sector is nuanced, dominated by independent (family-owned) entities on the one hand, chain stores on the other and a gamut of manufacturers who have their own specialty when it comes to manufacturing jewellery, cut and polished diamonds as well as gemstones to both domestic as well as international markets.

The industry was eagerly waiting for the budget announcements hoping that a prolonged request to reduce customs duty on gold which currently stands at 12.5% for gold in the form of bullion and doré bars. In addition to this there is also 3% of GST on gold jewellery. However, these issues were not addressed at the budget leaving the industry disappointed.

The industry was eagerly waiting for the budget announcements hoping that a prolonged request to reduce customs duty on gold which currently stands at 12.5% for gold in the form of bullion and doré bars. In addition to this there is also 3% of GST on gold jewellery. However, these issues were not addressed at the budget leaving the industry disappointed.

Smuggling of gold is rampant and has been a challenge for Indian authorities to curb and high customs duty and taxes on gold are some of the main reasons, posing an undue disadvantage for the organised players. “We expected duty on gold to be reduced but that hasn’t happened. In fact, duty on silver has been increased to be in par with gold and platinum. We assumed the duty will come down by 2% and this was accounted for in the gold pricing over the last 15 days.

This will increase the disparity between books and non-books rates. GJC has been invited to address these concerns with the Finance Minister on February 4th. We will have more clarity after that. The encouragement shown towards the LGD sector should be extended to other parts of gems and jewellery too,” said Saiyam Mehra, Chairman, GJC.

Unexpectedly, duty on silver has been increased aligning it with gold and platinum. “The budget is not positive for the exports market. Now they have increased duty in silver as well. Acquiring raw material when it comes to precious metals is as it is very difficult because of pricing and a further increase in duty makes it even more challenging for companies who are into exports. We hope the government will look into this,” said Vijay Chordia, Valentine Jewellery, Jaipur.

Though it is heartening to see that a swathe of favourable reforms for the middle-class were announced, the industry was looking for the government to address some of the critical concerns that are impending growth for this sunrise sector.

"For the jewellery industry, the biggest disappointment is that the budget did not address the concerns over reduction in import duty on gold and the creation of a level playing field in prices between the regular market and grey market. In fact, silver has been brought on parity with gold and platinum at 15%.

The focus of the government continues to focus on supporting new technologies and the nascent lab grown diamond industry is seen as a potential high employment space, hence the grant proposed. The government has also placed impetus on promoting Lab grown diamonds as it is seen as a green initiative through the reduction in basic customs duty on seeds required for lab grown diamonds. What kind of impact this will have on consumers over all as well as the natural diamond industry remains to be seen,” said Dr. Saurabh Gadgil, Chairman and Managing Director, PNG Jewellers.

High taxes will hinder efforts to make gold an asset class, especially at a time when gold prices have risen world over.

“The thriving grey market has diluted efforts to reduce cash transactions and penalizes organised and compliant players,” said Somasundaram PR, Regional CEO, India, World Gold Council. However, conversion of physical gold to Electronic Gold Receipt will not attract any capital gains. “This will give an overall digital boost to the industry and promoting investments in electronic equivalent of gold. Directionally, this year’s budget can be considered positive for the industry,” added Somasundaram.

The middle-class is likely to have more disposable income with the implementation of revised income tax slabs.

“Even though duty on gold has not been reduced as expected, the budget is in favour for the upliftment of middle class in terms of personal tax rebates. Also, the budget is focused on improving the MSME sector. So, overall the announcements are positive,” said Sumit Dassani of Dassani Brothers, Mumbai.

Identifying the lab-grown industry as one of most rewarding sectors, the budget had announced a slew of reforms in favour of LGDs. As it is a technology-and innovation-driven emerging sector with high employment potential, the decision to promote LGDs will have a big impact on India’s overall gems and jewellery exports. It will also create awareness about this category amidst citizens.

“The budget is extremely favourable towards the lab-grown sector. India is one of the leading exporters of lab-grown diamonds, and the policy changes announced will further make India number 1 when it comes to lab-grown diamonds. The recommendations will foster employment opportunity in this sector as well as facilitate buying state-of-the-art LGD machinery and technology at competitive rates,” said Vipul Shah, Chairman, GJEPC.

"To encourage indigenous production of LGD seeds and machines and to reduce import dependency, a research and development grant will be provided to one of the IITs for five years," said the Finance Minister. Import duty on LDGs were decreased to nil from 5% to reduce the cost of production.However, not all retailers are thrilled about this move.

“While there are some decisions that give hope to business sectors, the Gem & Jewellery industry specifically doesn’t have much to rejoice about. One of our biggest expectations was a cut in the gold import duty but unfortunately there’s been no favourable decision in this regard. This means that the gold grey market will continue to thrive and pose a threat to jewellery brands who deal in legal, standardised, hallmarked gold. The announcement of funds for lab-grown diamonds is also a cause of worry for jewellers who deal in large scale natural diamonds,” said Varghese Alukka of Josalukkas Group.

Be the first to comment