DTC's Varda Shine urges the industry to look beyond the current problems towards a brighter future

Synthetic diamond, cultured diamond, man-made diamond, lab-grown diamond- a diamond made by man in controlled environment; it has not been naturally formed slowly in the earth’s bowels yet possesses the properties of a natural diamond !%%

These diamonds have been made for a long time for industrial use and then there was the Russian made variety talked about secretly in industrial circles, but the whole concept was revolutionalized by the diamonds pouring out of the US from companies like Gemesis Corporation and Apollo Diamond Inc.%%Today the luxury segment is growing and India is seen as a big consumer market. In such a scenario is there place for all products to exist side by side and enjoy their own market share and popularity? India being a diamond cutting and polishing centre of the world should it matter if a diamond is natural or cultured, when it has to be cut and polished? Shweta Dharia focuses a glimpse of the Synthetic Diamonds market in India.

Gordon Max, a seven year old brand manufacturing synthetic diamond simulants has opened its doors in India and has paved the way for other brands to follow. Having done its homework well GordonMax is confident it will do well in India. "India's vast middle class (thanks to the IT sector) with its expanding purchasing power and its almost untapped retail industry are key attractions for established retail brands wanting to enter the Indian market. In addition to that, India's luxury market, estimated to be the 12th largest in the world, has been growing at the rate of 25 per cent per annum. With a rapidly expanding population of high nett worth individuals, India could emerge as the next hub for luxury goods consumption. So, based on all these indicators, we are convinced that GordonMax will be well received in India," says Saraswathi Arjunan, GordonMax India, Executive Director. %%

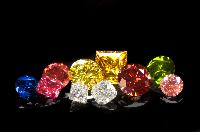

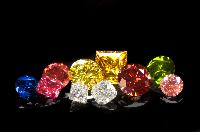

GordonMax’s primary product line are the loose diamond simulants, which are hand-cut and hand polished by master diamond cutters. A premium quality simulant with lifetime warranty on color, brilliance and fire and the highest grade of cut (master cut), clarity (flawless-VVSI) and color (D) at only fraction of the cost. GordonMax’s diamond simulants have higher melting point than 18kt gold and can be set into elegant and affordable gold/platinum jewellery pieces. They have various sizes from 0.25ct up to 12ct in many cuts such as Round Brilliant in Hearts and Arrows proportions, Princess, Emerald, Heart and many more. Their diamond simulants are developed in Europe, using an innovative and proprietary scored for prices. They also sell a secondary product line of Plated Ready to Wear collection. From pristine colorless to fancy vivid colors, the limited European design collections are set in 92.5sterling silver plated in 18kt. white/yellow gold.

%%

{{India’s Vast Potential :}}

GordonMax wants to cash in on India’s potential. They are targeting the mid- luxury segment of the market. This segment encompasses the young working population, nuclear families in urban areas, working-women population, senior corporate figures to high-heeled, cream of the society. "India is well known for its diamonds and gemstones jewellery. However at the same time, there is lack of choice and quality when it comes to man-made gemstones. Although no one has introduced premium quality diamond simulant in a big way in India yet, we are confident that consumers would appreciate that now they have a choice – to have elegance of wearing diamonds at a very affordable price tag and yet not to compromise either on the quality or eye appeal," explains Arjunan.

%%

{{Not Competitors :}}

The natural diamond Industry has reacted in extraordinary ways to GordonMax in India. "Some are amused (laughed about it); some were astonished by the excellent ‘eye appeal’ and some bought our gemstones just to make comparisons. Most experts in the diamond trade are magnanimous people due to the fact that they are professionals and they are confident that we will not impact the diamond trade," says Arjunan. She however stresses the fact that they are not competitors and are offering an alternative to those who need it. They use natural diamonds in their designs for sizes below 0.25Cts.%%

GordonMax is tightlipped about its technology and manufacturing process or even its turnover or production capacity of its plants. But other producers are not shying away from keeping all cards on the table. They in fact want to prove that they are transparent and win consumer confidence for their products. Gemesis and Apollo who use two different processes to manufacture diamonds explain about their diamonds.%%

Gemesis founder discovered the HPHT split sphere technology in Russia in 1996. Though many years of research and development, Gemesis has been able to turn the basic concept into a commercially viable venture. "Gemesis does not create diamonds in as much as it uses the HPHT split sphere technology to create or emulate the environment that exists 100 miles below the earths surface and just as in nature when carbon is exposed to these high pressures and temperatures it crystallizes into diamond," says Clark McEwen, Chief Operating Officer, The Gemesis Corporation. He joined Gemesis after spending 20 years in the mined diamond industry. "I have worked in pretty much every aspect of the diamond supply chain from mine to mall. After creating the Canadamark program for BHP Billiton I was looking for an interesting, challenging and innovative situation in the diamond business...making diamonds turned out to be that situation. How often in ones career do they get to make history!" he exclaims. %%

{{No Gemesis Jewellery :}}

Gemesis is currently commercially producing diamonds in the yellow to orange range of colors. "If you were to compare a Gemesis diamond to a mined diamond of similar color, size and quality the price difference at retail would be about 3 to 1 in favor of the mined diamond," explains McEwen. When asked if it plans to make jewellery with its diamonds McEwen clarifies that Gemesis sells its rough diamonds to companies that have the capability to polish the gemstones, create a branded line of jewellery featuring the Gemesis diamond and the ability to distribute this line to fine jewellery retailers worldwide. As long as their customers continue to follow this model they feel that there is no need for Gemesis to produce jewellery.%%

Gemesis manufacturing facility is located in Sarasota, Florida and the company employees approximately 60 people. Their annual production is roughly around 100,000 carats that average 3cts in size. Demand for Gemesis diamonds has been growing continuously as the trade- retailers and consumers- become more and more educated about the Gemesis diamond. The companies that buy from Gemesis are the same ones that are buying and polishing mined diamonds. "Currently our customer base includes DTC Sightholders, Rio Tinto Select Diamantaires as well as BHPB core customers...or to put it another way some of the most prestigious diamond companies in the world," says McEwen. Gemesis rough is being sold to countries like US, India, Israel, South Africa, Belgium, Thailand, Mauritius and Dubai.%%

Gemesis currently sells rough diamonds to India which are either polished and exported to other countries or used for domestic consumption. The rapid growth of the Indian consumer market and the obvious appreciation that the Indian consumer has for fashion and color, Gemesis sees India as a very important market. Clark McEwen recently paid a visit to India to study the markets and meet interested jewellery manufacturers.

%%

%%

{{Acceptance Increasing :}}

"Just as with any disruptive technology that commercially threatens an established traditional industry many are initially fearful of how this newcomer will affect their existing business. Having said that the acceptance of Gemesis grown diamonds within the industry is increasing daily," concludes McEwen.%%

{{De Beers Too Keeping Abreast !}}

Amongst all the producers of natural diamonds, mined from the bowels of the earth, only De Beers has its own facility to manufacture synthetic diamonds, in the Isle of Man. This was set up to counter the threat and competition from the Russians in the past. De Beers, in theory, can become the largest producer of man-made diamonds, if only to counter the threat from man-made producers and to guard its own turf. It could be able to control the flow of synthetic diamonds and control the market. %%

{{Apollo Joins the Race :}}

It needs to be seen how strong are emerging producers of man-made diamonds? Apollo another manufacturer of diamonds was founded in 1990 to develop a way to grow large diamond crystal for technology applications such as optics and electronics. Dr. Robert Linares, an expert in the field of crystal growth technologies, was the primary driving force behind the formation of the Company and its initial scientific progress. Apollo Diamond quickly realized that it was able to consistently produce high quality diamond, large enough in size to be used for gem applications. Today, Apollo produces diamond for use in both the gem and technology industries.%%

%% {{Another Process – CVD :}} Apollo grows diamonds through a patented technique derived from the process known as Chemical Vapor Deposition (CVD). Apollo uses a growth chamber and meticulously places seeds roughly the size of shirt buttons into the chamber. Once the seeds are in place carbon is rained onto the seeds, and new diamond grows one carbon atom at a time, on top of the seed. The diamond is then inspected to ensure that it meets the high standards held by Apollo® before being cut, polished and sold.%% The Apollo Diamond manufacturing facility is located near Boston, Massachusetts. "The demand for diamonds grown by Apollo Diamond and for Apollo Diamond jewellery has been high. Currently, Apollo is selling a limited amount of cultured diamonds directly to consumers who are based in the United States (www.ApolloDiamond.com). We are also test-marketing our gemstones from a retail location in Boston, Massachusetts, Bostonian Jewelers (www.BostonianJewelers.com)," says Bryant Linares of Apollo Dimaonds. Apollo also makes jewellery of its diamonds since 2006 and sells directly to its consumers. Their customers can anticipate getting up to 15 per cent better value when buying an Apollo grown diamond instead of a mined diamond. %%

Talking about the Indian markets Linares says, "We have received countless inquiries from consumers and diamond manufacturers in India and we continue to receive requests daily. Many Indian manufacturers understand that Apollo Diamond is developing a renewable resource for diamond that is targeted at meeting the needs of the growing supply-demand gap for diamonds world wide particularly due to such explosive growth in India and China."

%%

{{Initial Resistance Disappearing :}}

Apollo Diamond initially encountered resistance from certain corners of the mined diamond industry which anticipated to continue at some level for years to come. "However, major changes have taken place in the last year with the emergence of a fast growing contingent in the conventional diamond industry that recognizes the realities of the social, economic and environmental issues surrounding traditional extractive diamond mining and understands the issues of diminishing natural resources, environmental impact and social exploitation. This fast growing contingent also understands that the industry only hurts itself by trying to foist marketing terminology on diamonds that are grown instead of extracted. These progressive members of the diamond industry understand that there are limitations of the earth’s dwindling natural resources, such as diamond, and that Apollo Diamond is poised to fill the growing supply-demand gap for diamonds world wide," concludes Linares.

The producers of man-made diamonds say there is much change from when they started and the market has now become receptive to their product. But what do those who mine the naturals have to say? The DTC, Rio Tinto, and so on who have ruled the roost and now their clients are looking at other products and expanding their product lines. Do they look at this as competition or do they think it’s a good alternative when we consider the limited supply of naturals or they are reluctant to accept the man-made diamonds as diamonds?%%

%%

{{Rio Tinto Accepts Co-existence :}}

Rio Tinto Diamonds considers synthetic or man-made diamonds as legitimate products as long as they are properly disclosed to consumers. They believe that the consumers must be able to make informed choices and producers and retailers have a joint responsibility to ensure that they are not misled in any way about the nature of the diamond they are purchasing. "As long as this is ensured, we are confident that the natural diamond and man-made diamond markets can co-exist. They will cater to different market segments and different purchase occasions, at different price points," says Jean-Marc, General Manager, Rio Tinto Diamonds NV. "Rio Tinto Diamonds and the rest of the diamond industry will have to continue to focus on marketing-led differentiation of natural diamonds to maintain consumer confidence and build a strong future," he adds. Though currently the volumes produced of man-made diamonds are still negligible, over time, the category will probably grow as production capacities are expanded and costs go down. Rio Tinto doesn’t consider this as a threat to natural trade since they believe that this will lead to a further segmentation of the market, with the possible result of expanding the overall appetite for diamond jewellery. %%

"Moreover, the long term supply/demand dynamics for the natural diamond industry indicate a sizeable gap in supply and very strong demand from existing markets and the emerging markets of China, India and the Middle East. Given strong demand fundamentals for natural diamond, they are unlikely to be impacted by production of man-made diamonds in the short run, and will certainly retain their attractiveness and uniqueness in the consumers’ eyes for many years to come," explains Jean-Marc.%%

%%

{{Nothing Beats the Real Thing !}}

He gives an example of the Argyle Pink Diamonds: despite the growing availability of treated pink diamonds in the market, Argyle Pink Diamonds have retained their allure, and if anything have seen strong demand increase in the past few years, resulting in significant price appreciation. This is because –as we know – "nothing beats the real thing!" exclaims Jean-Marc. %%

{{Certification Needed :}}

"It is clear that there could be attempts to sell man-made diamonds as real diamonds. This is where detection comes into play and why proper disclosure is so important. This is why we welcome man-made diamond certification by grading labs, as it will ensure that detection technology is kept current and widely distributed, says Jean-Marc clarifying the scope for frauds that could arise.

Rio Tinto has taken care to implement Best Practices at every level in the diamond and jewellery supply chain. It is a founding member of the CRJP and contributes to developing industry standards in the area of disclosure and terminologies. In the case of pink diamonds, they are working very actively on a new generation of detection devices which they hope to be able to distribute to the Argyle Pink Diamond customers soon.%%

%%

{{DTC Differentiates :}}

DTC on the other hand says that diamonds are unique, whereas synthetics are artificial. Diamonds have captured hearts and minds for centuries and it is this sense of wonder and history, combined with the fact they are truly unique and rare, that gives them their value. They say that diamonds have special meaning and that they are the only way to show how much you value the people who matter – and how much you value yourself. "Synthetics don’t enshrine core human values and emotions and so it would be misleading to give the impression that they are the same thing," says Prasad Kapre of DTC.%%

{{But, Not a Threat :}}

He doesn’t consider synthetics as a competition to naturals since the amount of synthetics being manufactured for gems is negligible. "There are very few of them out there," he adds. "Secondly, this is not a "threat" to the industry or the consumer. Indeed, there are many very beneficial uses for synthetics such as in laser technology, medical and scientific equipment, industrial drill bits and abrasives. However, it is a fact that when it comes to diamonds, consumers tell us they want the real thing. As an industry, our challenge is to make sure the consumers have confidence in their purchase and are not misled," said Kapre. %%

%%

{{Majority Wants ‘Real Thing’ :}}

He however doesn’t equate the synthetic stones to diamonds and explains that diamonds are rare and special things with an inherent value that does not exist in factory-made synthetics. He believes that synthetics are akin to simulant stones, such as CZ. "They’re not new, and the fact people buy them as costume jewellery is not new – but they’re a very different product to a diamond," he adds. DTC’s extensive independent research shows that the majority of consumers want the real thing and aren’t prepared to settle for anything less.%%

{{Emphasis on Detection :}}

"We believe in our product and we know that consumers do too. We know that people want to buy the real thing, so of course we need to be sure that we can identify materials like synthetics quickly and easily. This is why we continue to invest in R&D into the detection of synthetics, simulants and treatments and we continue to support the industry in its own attempts to ensure that detection is possible and proper disclosure to trade members and consumers takes place," says Kapre. A number of different detection machines are on the market. The DTC has developed two machines – known as DiamondSure and DiamondView – to ensure that all simulants and synthetics are easily detected.%%

{{Disclosure Must :}}

Kapre at the same time doesn’t ignore the potential challenges from misrepresented or undisclosed diamond simulants or synthetics. "Each business in the industry has a responsibility for ensuring that the consumer is never misled. For example, synthetics should be proactively and fully disclosed," he says.%%

Does the industry at large echo the same views as DTC? The natural diamond traders we spoke to have some interesting views on the issue. %%

J.B. & Brothers, established in 1983 is a leading diamond manufacturer and exporter from India. The group has spread its wings and operates in all major centres in the world like Belgium, Canada, USA, South Africa and Hong Kong. They believe that it is difficult to replace a natural diamond with synthetic diamond; however they admit that synthetic diamonds have the same strength and similar characteristics as a natural diamond. The scope for frauds in diamond industry cannot be denied, "if jewellers can be cheated then there is a very high possibility that a consumer too can be cheated," said Shailesh Shah, of J.B.Brothers. "If there is no control in the diamond industry then there is definitely a possibility that there will be a parallel synthetic diamond market to compete with that of natural diamonds," he adds. However nothing can replace a natural diamond he says. They sell diamonds on consumer trust and all their customers and potential customers know that they are 100 per cent committed to selling natural diamonds.%%

%% {{Synthetic – Not cultured:}} Another known name in the Industry Shasvat Diam who sells loose diamonds between in fancy colors says synthetic diamonds are no threat, since Indian consumer market is strong and people know what they want. "People know the difference they know naturals are real diamonds," says Punit Shah of Sashvat Diam. He at the same time believes that it is very difficult to differentiate between natural and synthetic and almost impossible for a consumer to do so. There will be scope for frauds he says but it is important to know where to buy from. "The synthetic stone brands that have come to India have proper disclosure methods and are again brands so they will educate and sell to the customer. They should however be called synthetic and not cultured since it can be confusing like the cultured pearls," he explains. He goes on to say that, "The natural pearl market was totally eaten up by cultured pearls… it might happen with diamonds but not so soon… however the possibility cannot be denied,"%%

%%

A four decade old company Suashish Diamonds Ltd. (SDL), a Diamond Trading Company (DTC) Sightholder and one of India’s leading diamond and diamond jewellery manufacturing and exporting group says Synthetics are not going to affect the natural markets. If the industry maintains integrity and practices full disclosure at all levels of trade then probably synthetic could carve a niche market for itself. Gopal Laddha, CFO, Suashish Diamond Ltd. says, "I have come across synthetic diamonds mostly in Mumbai. There is no visual difference between synthetics and natural diamonds, and hence there is a possibility of consumers being cheated or misled by some fraudulent players in the industry. The sale of diamond studded jewellery under brands / organized players will protect customers from having confusion of what they are buying," says Laddha. He accepts the fact that synthetics are diamonds but says, "They lack the rarity and clarity factor and its best to call them man-made diamonds."%%

{{There is Place for Everyone :}}

Most notables agree that synthetics will not harm the natural trade and might carve a niche for themselves. Sanjay Kothari, Chairman of GJEPC says, "There will be a choice for consumers and the product will not harm the natural trade. There is place for everyone and the consumer will choose the best."%%

Today India has a few synthetic diamond manufacturing units, but they are said to produce industrial diamonds. With a little research these units might be able to produce gem quality diamonds. Industrial Diamonds India Ltd. has a licensed capacity of 1.6 million carats and an installed capacity of 2.0 million carats. It has a technical collaboration with Industrial Diamond Engineers AB Limited, Finland. The unit is located near Madurai, in Tamil Nadu. The plant was commissioned in October 1988. The synthetic diamonds produced in trial runs are understood to have been given for user trials. Another unit is the Napro Synthetic Pvt. Limited., Bombay. The unit has a licensed capacity of 1.5 million carats and an installed capacity of 1.5 million carats. It has a, technical and financial collaboration, with U.S. Synthetic Corporation, U.S.A. The plant is located at Bharuch. The plant was commissioned in October-November 1988. However, no details of production, quantities sold and the quality of the product are available.%%

{{Chinese Threat !}}

The present synthetics produced all over the world are mostly colored and the ones closer to the natural whites have the yellow hue. The market is seeing more and more of yellow gemstones suddenly appearing on its horizon and this is a cause for concern. Another looming threat is that of the Chinese cultured diamonds, which make us recall the Chinese batteries and cheap toys.%%

In the ultimate reckoning the greatest danger is from human morals! The possibility of frauds and cheating that can erode consumer confidence, if proper disclosure methods are not applied, remains the single most serious menace. If this happens the natural diamond industry will have to bear the brunt.

Be the first to comment