|*There has been a pick-up in imports and exports across all the major centres during the first half of 2010. But the recovery from the dark days that began in the last quarter of 2008 is far from complete. Key markets are still reeling under the impact of the slump, and new emerging markets, though stronger, are small in absolute terms. $$

Amidst the beginnings of the recovery, one key aspect that is becoming clear is that the recession has speeded up a process of realignment, and that the contours of the diamond world that emerges will be somewhat different from the one that we knew till now.$$

{{Stephen Rego}} takes stock of the situation midway through what is going to be a critical year for the diamond industry, and maps some important realignments that seem to be taking place.*|%%

Small smiles can now be seen on the faces of diamantaires across the world. %%

The reason – there are signs of the beginning of a recovery, although a slow one. After enduring a dull and dismal 2009, a more positive story seems to be unfolding, going by the figures for the first half of 2010 released by different manufacturing and trading centres round the world. India’s polished exports were xxx% up by value compared to the first six months of 2009, while Israel saw a surge of 91.7 per cent and Belgium reported a rise of 32.2 per cent in their respective polished exports as well. %%

No doubt rising prices and currency fluctuations have played their part, and the figures may not be as bright when looked at in volume terms. Thus, while India exported xxx mn carats polished, up xxx per cent from 2009, Israel registered a 63 per cent increase to 1.6 mn carats and Belgium managed a 2.5 per cent rise from the same period of 2009 to 3.63 million carats. Though slower than the increase in value terms, this still represents a growth of sorts, however. Of course, a comparison with 2008 figures provides some additional insights that shall be discussed subsequently. %%

News on the mining front was also more positive than the previous year. Analysts estimate that at the end of the June sight, total DTC sales in the first six months of 2010 at US$ 2.5 billion, were about 80 per cent above the levels of 2009. Preliminary reports also indicate that Alrosa clocked US$ 1.9 billion worth of diamond sales for the first half of 2010, up almost 50 per cent over 2009. Rio Tinto’s diamond production in the first half of the year totaled 7.1 million carats, up 5 per cent from the first half of 2009.%%

So even though the major markets in the US, Europe and Japan are still looking weak, the process of restocking that has begun there coupled with stronger growth in India and China, has seen some momentum returning to the trade.

While addressing delegates at the World Diamond Congress in Moscow in mid-July, WFDB President Avi Paz summed up the situation thus, “Fortunately, in the past few months we are witnessing signs of recovery and return to gradual growth.â€%%

Similar sentiments are voiced by people in different countries and various stages of the pipeline. "2010 continues to shape up well for Rio Tinto and we are driving our operations at close to capacity," says Tom Albanese, Chief Executive Officer. "Markets for most of our products are strong and the overall long-term demand outlook is positive."%%

Moti Ganz, Chairman of the Israel Diamond Institute Group of Companies (IDI), said that he was pleased with the recovery shown by the figures. “We are not surprised by the statistics, since the Israeli Diamond Industry is experiencing a pronounced upturn in activity. We are confident that the Israeli industry will continue to grow. We look forward to a return to our previous levels of activity,†he said.%%

Vasant Mehta, Chairman, GJEPC, believes that there is a slow revival of demand in the consuming countries. He says, “Overall situation in the in the world is that people are cautious but are coming back to the stores. The market however is still slow overall.â€%%

Echoing this is Nishit Parikh, newly elected President of AWDC. Parkh believes, “Everything looks good, but the world market is still fragile. A new economic downturn somewhere could affect the diamond industry, alongside other industries. The Antwerp diamond companies are doing business again, and have proven to be stable and solid. Nevertheless, financial stability is of utmost importance, and the market must be very careful not to overheat.â€%%

During his address to the World Diamond Congress, Ganz, who is also President IDMA, noted, “The industry is currently at a crossroads. But it has the power to make the post-crisis situation a defining moment in the diamond industry's history.â€

{{Demand: Revival is Slow }}%%

One key defining factor in the new direction for the industry will be the changes in demand patterns. Already, the strong performance of the newer markets has been one of the causes for hope. Meanwhile in the short run, some revival has been fuelled by the US market. During January – May 2010, net polished imports totalled $1.96 billlion, compared with $1.15 billion one year ago.%%

A closer look however reveals that this improved movement of goods, and the revival in manufacturing and trading is not firmly based on a long term revival in demand.%%

In terms of key markets, the world’s largest diamond consumer market is still the United States accounting for over 40 per cent of the global diamond demand with Europe adding another 14 per cent. These two markets have been severely hit by the financial crisis, the US from late 2008 onwards while Europe has seen some of its worst problems earlier this year.%%

While an estimated 20 per cent retailers have closed down over a span of 15 months, there is general agreement with an opinion voiced by Sean Cohen of Codiam International that “2010 is better than 2009 for sureâ€.%%

But this is only a relative assessment, things are nowhere near the levels of 2008, and many analysts believe that demand is going to be slow for a long time to come.%%

GJEPC’s Mehta observes that most Americans are now only purchasing for basic needs. “Bridal demand remains, but buying a second piece is being curbed or deferred.†%%

Taking a longer term view, Parikh of AWDC believes that there may be “an annual jewellery sales growth of 4-5 percent over the next decade which will be fuelled by bridal demand, some expansion of the market, an increase in life cycle milestones, more female self-purchasers etc.â€%%

In the shorter term however, demand is going to be mainly fuelled by restocking of inventory, and with extreme caution (see Accompanying story ….. US Market at the end).

Analysts indicate that there has also been a huge drop in consumer demand due to the withdrawal of ‘aspirational’ shoppers who were earlier willing to spend future income on current luxuries. Though luxury spending is up 14.3 per cent compared to a year ago, according to SpendingPulse, which comes from MasterCard Advisors and includes estimates for U.S. sales across all payment forms, this has to be seen in context -- spending at the highest-end department stores, restaurants, grocery stores and leather goods stores fell 2.9 percent in 2008 and 8.2 percent in 2009.%%

As Ganz puts it, “The facts on the ground show that the US market is reducing its market share in polished diamond sales, though it is still leading. The demand in the United States is on the decline in terms of quality, as well. The current focus is on lower quality and lower prices, at a time when many in the industry would like to see the market return to consuming high-quality goods.†%%

Both Europe and Japan are also grappling with the effects of the slowdown. A special crisis management plan helped weather the immediate storm in Greece, but the shadow of recession still looms over large parts of Europe%%

William Susman, chief operating officer of boutique investment bank Financo Inc. says, "What the economies throughout Europe are going to go through in the next six to 18 months, I think, will be dramatic," he said. "It will impact France, Germany and the northern Scandinavian countries as well. So I don't think that that story is over yet."%%

In Japan, while there are some weak indicators to suggest that the worst may be over (Japanese wage earners' total cash earnings rose the most in 4- years in April, climbing 1.5 percent from a year earlier and Consumer confidence has also crept back to the highest levels seen since October 2007), this Is not necessarily an indication of any immediate positive growth. U.S. Management consultants Bain & Company excluded the Far East market from their prediction of a 4 per cent growth in the luxury market for 2010. There they see a 3 per cent fall in luxury sales, following the 10 per cent drop in 2009. McKinsey & Company reported luxury sales were down about 5 to 6 percent for the first quarter.%%

Significant for the diamond industry is the fact that while specialty stores in Japan increased their sales by 2 per cent year-on-year over 2009, the story from jewellery stores where sales decreased 11.2 per cent was quite different.

It is only India and China, among the bigger markets where there has been some indication of steady growth in diamond demand. De Beers estimates that China’s share of the diamond jewellery market should double to 16 per cent by 2016. While no clear projections exist for the Indian market, various estimates believe that the market will continue to display double digit growth over the next few years and continue to be the third largest consumer of diamond jewellery. It is believed that over the next 5-6 years, with the decline in the US, and growth in these two new markets, India and China together will have as big a market share as the US itself. But that is still some way into the future.%%

Parikh summarizes the market scenario thus, “We are facing two realities: 1) a stagnating economy in the US, Europe and Japan and 2) an economy which is not affected by the notion of ‘crisis’, in the Far East. There is no doubt that in the coming years, India and China will fuel the global diamond trade.â€%%

{{Supply: Shortages Persist}}%%

On the supply side too, though figures for 2010 as discussed earlier, are in positive territory, this is relative to a period in 2009 that saw mining activity virtually grind to a halt.%%

“The current demand for rough diamonds exceeds the supply and there is a growing shortage of certain articles that are in high demand,†Ganz stated in his address at IDMA. “Today there are no inventories with the producers; they are selling current production immediately.â€%%

Giving a quick recap of the mining scenario over the last 18 months, Praveenshankar Pandya, Chairman, Diamond India Ltd (DIL) says that during the worst period demand for rough fell due to lack of movement in polished and the liquidity crunch. As a result rough prices dropped by about 30 per cent, there was little availability and direct customers of miners were the only ones with some goods. By mid 2009 there was a recovery as the pipeline cleared to an extent, demand for rough shot up and prices jumped. However over the next few months some equilibrium was reached. %%

While some short term price spikes may continue, GJEPC chairman Vasant Mehta believes that manufacturers are now more cautious. “While there is little rough being chased by many, profit margins are currently under pressure and manufacturers are cautious. Unlike in the pre-recession times, manufacturers have now sent out a clear message – rough will no longer be picked up at unrealistic prices.â€%%

In fact the WFDB/IDMA have sent a clear message to the miners, calling on them to “allocate sizable volumes of merchandise for sale outside of the tender systemâ€. They opined that tenders not only place smaller and medium manufacturers at a disadvantage, but also prevents “members of the diamond sector (from) implement(ing) any long-term strategic planning, including manufacturing and marketing programmesâ€.%%

Interestingly it also called for “increased co-operation with banks financing the diamond industry, so that credit will be available to all sectors of the industry as the diamond market enters a new growth phaseâ€.%%

In the long term most miners are of the view that supply will continue to be limited by the new economic realities. There are question marks over how much more supply can be expected from the existing mines, expectations from Canada are dramatically lower than what they were earlier, and there is no clear time frame over the underground development of the Argyle mine.

Gareth Penny recently told the media that diamond supply would decline in the future. "These great mines that were discovered 10, 20, 30 years ago are not being replaced today. According to the data that is out there, we're going to see some significant declines in diamonds."%%

The only area where rough seems to be more easily available – Zimbabwe – is shrouded in controversy, and while the agreement reached at the WDC meeting in St Petersburg provides some temporary relief, it is no more than that.%%

{{Concerns about profitability }}%%

Squeezed between the producers and the retailers, diamond manufacturers have seen severe declines in margins over the last decade, itself triggering off some changes. The recession on the one hand further speeded up this process, and on the other has seen the beginning of a shift that will significantly alter the relative balance between the three main centres --- Antwerp, Israel and India.%%

The squeeze on profitability is being raised at various levels. THE WFDB urged manufacturers to “internalize the lessons†of the crisis and “….(reduce) significantly the volume of goods being sold on consignment and also cut the standard periods for which terms of credit are extended.â€%%

At the IDMA meeting, Ganz was even more forthright. Noting that jewellery manufacturers, distributors and retailers have depleted their stock and are now in a replenishment mode, he called on manufacturers to be cautious in dealings with the retail sector.%%

“The current demand for rough diamonds exceeds the supply and there is a growing shortage of certain articles that are in high demand. Yet despite the shortage of rough, the polished retailers are still setting the terms of trade: they are dictating the prices, the periods of credit, the volumes they want on consignment,†he said. %%

{{Manufacturing Map: Signs of change}}%%

One important fall out of this period has been a subtle remapping of the manufacturing world. Analyst Chaim Evan Zohar earlier this year drew attention to the fact that India was the only one important centre that seemed to have weathered the storm in the financial markets. He noted that the India centre actually finished what many described as the worst year in the diamond industry’s history just a miniscule 1.7 per cent below its 2008 figures, while in carat terms exports were actually up 13 per cent.%%

India’s share of the US market rose from 20 per cent earlier in the decade to 25 per cent, while Israel’s fell from 53 per cent to 45 per cent and Antwerp’s share remained steady. He also noted a similar trend in the Japanese market.%%

Going forward, the picture at the end of the first half of 2010 has further confirmed this trend. India has surpassed its export levels of 2008, and Belgium is marginally behind, but Israel has seen some significant declines. In terms of the all important US market too, india’s share has continued to rise, and is now estimated to be nearly 30 per cent.

The Indian recovery too has been fairly swift and smooth. GJEPC’s Mehta and DIL’s Pandya estimate that while in its worst phase, manufacturing dropped to 50 per cent levels, today they are back at 75-80 per cent.%%

Industry sources believe that India’s share of the market in value terms has actually shot up from 60 per cent in 2008 to between 65-70 per cent post the recession. %%

How has this happened? They aver that between February and October 2009 when rough prices had declined significantly more than polished, the Indian industry took over a large bit of the ‘dossier’ business i.e. polished up to 0.99 pointers which are sold with dossiers rather than certificates. It is estimated that if before the crisis the ratio was 40:60 in Israel’s favour, today it has become 80:20 in India’s favour. %%

Sources indicate that this shift is also reflected in the manufacturing patterns in Surat – while about 30 per cent of smaller manufacturers have moved out of the business, through a process of consolidation many manufacturers have moved up the value chain in a major way doing better quality and larger goods larger goods in the 0.50 to 1.50 cts range.%%

{{Going Forward: Promotion is the Key}}%%

While these realignments are definitely good news for the India centre, the fact remains that there are still enormous challenges ahead. %%

Vasant Mehta quite frankly admits, “We are getting a beating from other product categories, and need to pay attention to promotions of the diamond jewellery category in a big way.†%%

Ganz described it saying, “Consumers can still buy three pieces of diamond jewellery for the price of one Louis Vuitton bag. The price of diamonds today should be at least 200 per cent more than their price in the 1990s. Just look where gold and platinum are and look where we are!"%%

IDMA noted that, "It seems that all parties that had been asked to support this important venture (IDB) understand the value of the creation of an entity that will advance generic diamond promotion and advertising projects in the global diamond jewellery consumer markets. IDMA sincerely hopes that the parties involved will make significant progress soon.â€%%

Mehta feels that taking ahead the International Diamond Board (IDB) initiative is “the need of the hourâ€. %%

“We must work towards increasing demand worldwide and should consider taking ahead the IDB initiative even if one or two stakeholders remain outside,†he concludes.

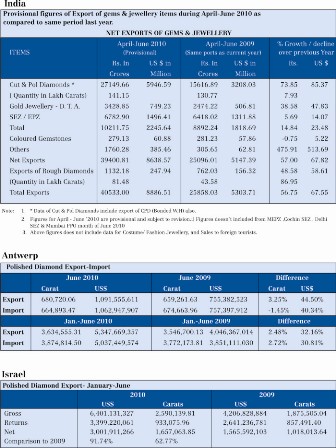

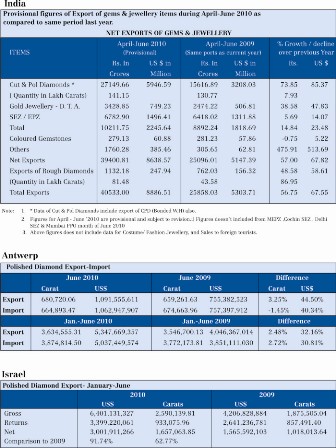

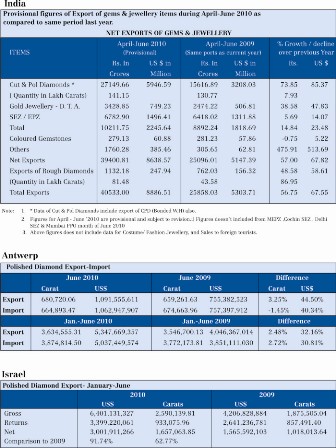

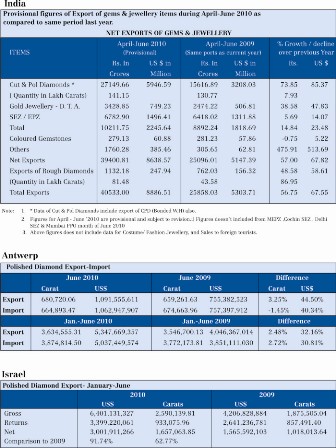

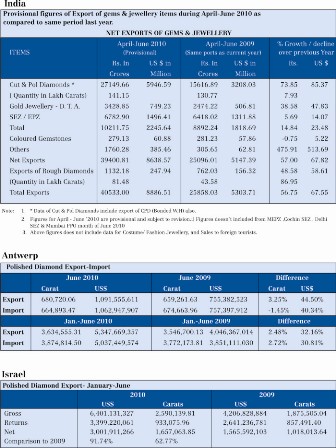

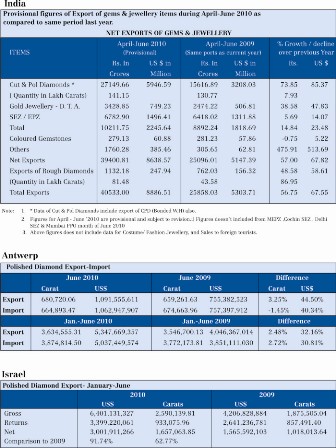

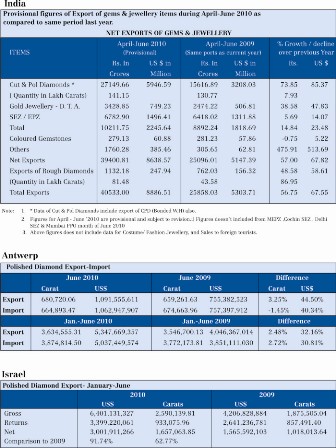

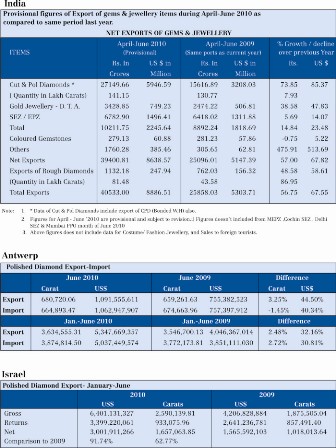

Table 1(India), 2(Antwerp) & 3(Israel)

|*There has been a pick-up in imports and exports across all the major centres during the first half of 2010. But the recovery from the dark days that began in the last quarter of 2008 is far from complete. Key markets are still reeling under the impact of the slump, and new emerging markets, though stronger, are small in absolute terms. $$

Amidst the beginnings of the recovery, one key aspect that is becoming clear is that the recession has speeded up a process of realignment, and that the contours of the diamond world that emerges will be somewhat different from the one that we knew till now.$$

{{Stephen Rego}} takes stock of the situation midway through what is going to be a critical year for the diamond industry, and maps some important realignments that seem to be taking place.*|%%

Small smiles can now be seen on the faces of diamantaires across the world. %%

The reason – there are signs of the beginning of a recovery, although a slow one. After enduring a dull and dismal 2009, a more positive story seems to be unfolding, going by the figures for the first half of 2010 released by different manufacturing and trading centres round the world. India’s polished exports were xxx% up by value compared to the first six months of 2009, while Israel saw a surge of 91.7 per cent and Belgium reported a rise of 32.2 per cent in their respective polished exports as well. %%

No doubt rising prices and currency fluctuations have played their part, and the figures may not be as bright when looked at in volume terms. Thus, while India exported xxx mn carats polished, up xxx per cent from 2009, Israel registered a 63 per cent increase to 1.6 mn carats and Belgium managed a 2.5 per cent rise from the same period of 2009 to 3.63 million carats. Though slower than the increase in value terms, this still represents a growth of sorts, however. Of course, a comparison with 2008 figures provides some additional insights that shall be discussed subsequently. %%

News on the mining front was also more positive than the previous year. Analysts estimate that at the end of the June sight, total DTC sales in the first six months of 2010 at US$ 2.5 billion, were about 80 per cent above the levels of 2009. Preliminary reports also indicate that Alrosa clocked US$ 1.9 billion worth of diamond sales for the first half of 2010, up almost 50 per cent over 2009. Rio Tinto’s diamond production in the first half of the year totaled 7.1 million carats, up 5 per cent from the first half of 2009.%%

So even though the major markets in the US, Europe and Japan are still looking weak, the process of restocking that has begun there coupled with stronger growth in India and China, has seen some momentum returning to the trade.

While addressing delegates at the World Diamond Congress in Moscow in mid-July, WFDB President Avi Paz summed up the situation thus, “Fortunately, in the past few months we are witnessing signs of recovery and return to gradual growth.â€%%

Similar sentiments are voiced by people in different countries and various stages of the pipeline. "2010 continues to shape up well for Rio Tinto and we are driving our operations at close to capacity," says Tom Albanese, Chief Executive Officer. "Markets for most of our products are strong and the overall long-term demand outlook is positive."%%

Moti Ganz, Chairman of the Israel Diamond Institute Group of Companies (IDI), said that he was pleased with the recovery shown by the figures. “We are not surprised by the statistics, since the Israeli Diamond Industry is experiencing a pronounced upturn in activity. We are confident that the Israeli industry will continue to grow. We look forward to a return to our previous levels of activity,†he said.%%

Vasant Mehta, Chairman, GJEPC, believes that there is a slow revival of demand in the consuming countries. He says, “Overall situation in the in the world is that people are cautious but are coming back to the stores. The market however is still slow overall.â€%%

Echoing this is Nishit Parikh, newly elected President of AWDC. Parkh believes, “Everything looks good, but the world market is still fragile. A new economic downturn somewhere could affect the diamond industry, alongside other industries. The Antwerp diamond companies are doing business again, and have proven to be stable and solid. Nevertheless, financial stability is of utmost importance, and the market must be very careful not to overheat.â€%%

During his address to the World Diamond Congress, Ganz, who is also President IDMA, noted, “The industry is currently at a crossroads. But it has the power to make the post-crisis situation a defining moment in the diamond industry's history.â€

{{Demand: Revival is Slow }}%%

One key defining factor in the new direction for the industry will be the changes in demand patterns. Already, the strong performance of the newer markets has been one of the causes for hope. Meanwhile in the short run, some revival has been fuelled by the US market. During January – May 2010, net polished imports totalled $1.96 billlion, compared with $1.15 billion one year ago.%%

A closer look however reveals that this improved movement of goods, and the revival in manufacturing and trading is not firmly based on a long term revival in demand.%%

In terms of key markets, the world’s largest diamond consumer market is still the United States accounting for over 40 per cent of the global diamond demand with Europe adding another 14 per cent. These two markets have been severely hit by the financial crisis, the US from late 2008 onwards while Europe has seen some of its worst problems earlier this year.%%

While an estimated 20 per cent retailers have closed down over a span of 15 months, there is general agreement with an opinion voiced by Sean Cohen of Codiam International that “2010 is better than 2009 for sureâ€.%%

But this is only a relative assessment, things are nowhere near the levels of 2008, and many analysts believe that demand is going to be slow for a long time to come.%%

GJEPC’s Mehta observes that most Americans are now only purchasing for basic needs. “Bridal demand remains, but buying a second piece is being curbed or deferred.†%%

Taking a longer term view, Parikh of AWDC believes that there may be “an annual jewellery sales growth of 4-5 percent over the next decade which will be fuelled by bridal demand, some expansion of the market, an increase in life cycle milestones, more female self-purchasers etc.â€%%

In the shorter term however, demand is going to be mainly fuelled by restocking of inventory, and with extreme caution (see Accompanying story ….. US Market at the end).

Analysts indicate that there has also been a huge drop in consumer demand due to the withdrawal of ‘aspirational’ shoppers who were earlier willing to spend future income on current luxuries. Though luxury spending is up 14.3 per cent compared to a year ago, according to SpendingPulse, which comes from MasterCard Advisors and includes estimates for U.S. sales across all payment forms, this has to be seen in context -- spending at the highest-end department stores, restaurants, grocery stores and leather goods stores fell 2.9 percent in 2008 and 8.2 percent in 2009.%%

As Ganz puts it, “The facts on the ground show that the US market is reducing its market share in polished diamond sales, though it is still leading. The demand in the United States is on the decline in terms of quality, as well. The current focus is on lower quality and lower prices, at a time when many in the industry would like to see the market return to consuming high-quality goods.†%%

Both Europe and Japan are also grappling with the effects of the slowdown. A special crisis management plan helped weather the immediate storm in Greece, but the shadow of recession still looms over large parts of Europe%%

William Susman, chief operating officer of boutique investment bank Financo Inc. says, "What the economies throughout Europe are going to go through in the next six to 18 months, I think, will be dramatic," he said. "It will impact France, Germany and the northern Scandinavian countries as well. So I don't think that that story is over yet."%%

In Japan, while there are some weak indicators to suggest that the worst may be over (Japanese wage earners' total cash earnings rose the most in 4- years in April, climbing 1.5 percent from a year earlier and Consumer confidence has also crept back to the highest levels seen since October 2007), this Is not necessarily an indication of any immediate positive growth. U.S. Management consultants Bain & Company excluded the Far East market from their prediction of a 4 per cent growth in the luxury market for 2010. There they see a 3 per cent fall in luxury sales, following the 10 per cent drop in 2009. McKinsey & Company reported luxury sales were down about 5 to 6 percent for the first quarter.%%

Significant for the diamond industry is the fact that while specialty stores in Japan increased their sales by 2 per cent year-on-year over 2009, the story from jewellery stores where sales decreased 11.2 per cent was quite different.

It is only India and China, among the bigger markets where there has been some indication of steady growth in diamond demand. De Beers estimates that China’s share of the diamond jewellery market should double to 16 per cent by 2016. While no clear projections exist for the Indian market, various estimates believe that the market will continue to display double digit growth over the next few years and continue to be the third largest consumer of diamond jewellery. It is believed that over the next 5-6 years, with the decline in the US, and growth in these two new markets, India and China together will have as big a market share as the US itself. But that is still some way into the future.%%

Parikh summarizes the market scenario thus, “We are facing two realities: 1) a stagnating economy in the US, Europe and Japan and 2) an economy which is not affected by the notion of ‘crisis’, in the Far East. There is no doubt that in the coming years, India and China will fuel the global diamond trade.â€%%

{{Supply: Shortages Persist}}%%

On the supply side too, though figures for 2010 as discussed earlier, are in positive territory, this is relative to a period in 2009 that saw mining activity virtually grind to a halt.%%

“The current demand for rough diamonds exceeds the supply and there is a growing shortage of certain articles that are in high demand,†Ganz stated in his address at IDMA. “Today there are no inventories with the producers; they are selling current production immediately.â€%%

Giving a quick recap of the mining scenario over the last 18 months, Praveenshankar Pandya, Chairman, Diamond India Ltd (DIL) says that during the worst period demand for rough fell due to lack of movement in polished and the liquidity crunch. As a result rough prices dropped by about 30 per cent, there was little availability and direct customers of miners were the only ones with some goods. By mid 2009 there was a recovery as the pipeline cleared to an extent, demand for rough shot up and prices jumped. However over the next few months some equilibrium was reached. %%

While some short term price spikes may continue, GJEPC chairman Vasant Mehta believes that manufacturers are now more cautious. “While there is little rough being chased by many, profit margins are currently under pressure and manufacturers are cautious. Unlike in the pre-recession times, manufacturers have now sent out a clear message – rough will no longer be picked up at unrealistic prices.â€%%

In fact the WFDB/IDMA have sent a clear message to the miners, calling on them to “allocate sizable volumes of merchandise for sale outside of the tender systemâ€. They opined that tenders not only place smaller and medium manufacturers at a disadvantage, but also prevents “members of the diamond sector (from) implement(ing) any long-term strategic planning, including manufacturing and marketing programmesâ€.%%

Interestingly it also called for “increased co-operation with banks financing the diamond industry, so that credit will be available to all sectors of the industry as the diamond market enters a new growth phaseâ€.%%

In the long term most miners are of the view that supply will continue to be limited by the new economic realities. There are question marks over how much more supply can be expected from the existing mines, expectations from Canada are dramatically lower than what they were earlier, and there is no clear time frame over the underground development of the Argyle mine.

Gareth Penny recently told the media that diamond supply would decline in the future. "These great mines that were discovered 10, 20, 30 years ago are not being replaced today. According to the data that is out there, we're going to see some significant declines in diamonds."%%

The only area where rough seems to be more easily available – Zimbabwe – is shrouded in controversy, and while the agreement reached at the WDC meeting in St Petersburg provides some temporary relief, it is no more than that.%%

{{Concerns about profitability }}%%

Squeezed between the producers and the retailers, diamond manufacturers have seen severe declines in margins over the last decade, itself triggering off some changes. The recession on the one hand further speeded up this process, and on the other has seen the beginning of a shift that will significantly alter the relative balance between the three main centres --- Antwerp, Israel and India.%%

The squeeze on profitability is being raised at various levels. THE WFDB urged manufacturers to “internalize the lessons†of the crisis and “….(reduce) significantly the volume of goods being sold on consignment and also cut the standard periods for which terms of credit are extended.â€%%

At the IDMA meeting, Ganz was even more forthright. Noting that jewellery manufacturers, distributors and retailers have depleted their stock and are now in a replenishment mode, he called on manufacturers to be cautious in dealings with the retail sector.%%

“The current demand for rough diamonds exceeds the supply and there is a growing shortage of certain articles that are in high demand. Yet despite the shortage of rough, the polished retailers are still setting the terms of trade: they are dictating the prices, the periods of credit, the volumes they want on consignment,†he said. %%

{{Manufacturing Map: Signs of change}}%%

One important fall out of this period has been a subtle remapping of the manufacturing world. Analyst Chaim Evan Zohar earlier this year drew attention to the fact that India was the only one important centre that seemed to have weathered the storm in the financial markets. He noted that the India centre actually finished what many described as the worst year in the diamond industry’s history just a miniscule 1.7 per cent below its 2008 figures, while in carat terms exports were actually up 13 per cent.%%

India’s share of the US market rose from 20 per cent earlier in the decade to 25 per cent, while Israel’s fell from 53 per cent to 45 per cent and Antwerp’s share remained steady. He also noted a similar trend in the Japanese market.%%

Going forward, the picture at the end of the first half of 2010 has further confirmed this trend. India has surpassed its export levels of 2008, and Belgium is marginally behind, but Israel has seen some significant declines. In terms of the all important US market too, india’s share has continued to rise, and is now estimated to be nearly 30 per cent.

The Indian recovery too has been fairly swift and smooth. GJEPC’s Mehta and DIL’s Pandya estimate that while in its worst phase, manufacturing dropped to 50 per cent levels, today they are back at 75-80 per cent.%%

Industry sources believe that India’s share of the market in value terms has actually shot up from 60 per cent in 2008 to between 65-70 per cent post the recession. %%

How has this happened? They aver that between February and October 2009 when rough prices had declined significantly more than polished, the Indian industry took over a large bit of the ‘dossier’ business i.e. polished up to 0.99 pointers which are sold with dossiers rather than certificates. It is estimated that if before the crisis the ratio was 40:60 in Israel’s favour, today it has become 80:20 in India’s favour. %%

Sources indicate that this shift is also reflected in the manufacturing patterns in Surat – while about 30 per cent of smaller manufacturers have moved out of the business, through a process of consolidation many manufacturers have moved up the value chain in a major way doing better quality and larger goods larger goods in the 0.50 to 1.50 cts range.%%

{{Going Forward: Promotion is the Key}}%%

While these realignments are definitely good news for the India centre, the fact remains that there are still enormous challenges ahead. %%

Vasant Mehta quite frankly admits, “We are getting a beating from other product categories, and need to pay attention to promotions of the diamond jewellery category in a big way.†%%

Ganz described it saying, “Consumers can still buy three pieces of diamond jewellery for the price of one Louis Vuitton bag. The price of diamonds today should be at least 200 per cent more than their price in the 1990s. Just look where gold and platinum are and look where we are!"%%

IDMA noted that, "It seems that all parties that had been asked to support this important venture (IDB) understand the value of the creation of an entity that will advance generic diamond promotion and advertising projects in the global diamond jewellery consumer markets. IDMA sincerely hopes that the parties involved will make significant progress soon.â€%%

Mehta feels that taking ahead the International Diamond Board (IDB) initiative is “the need of the hourâ€. %%

“We must work towards increasing demand worldwide and should consider taking ahead the IDB initiative even if one or two stakeholders remain outside,†he concludes.

Table 1(India), 2(Antwerp) & 3(Israel)

|*There has been a pick-up in imports and exports across all the major centres during the first half of 2010. But the recovery from the dark days that began in the last quarter of 2008 is far from complete. Key markets are still reeling under the impact of the slump, and new emerging markets, though stronger, are small in absolute terms. $$

Amidst the beginnings of the recovery, one key aspect that is becoming clear is that the recession has speeded up a process of realignment, and that the contours of the diamond world that emerges will be somewhat different from the one that we knew till now.$$

{{Stephen Rego}} takes stock of the situation midway through what is going to be a critical year for the diamond industry, and maps some important realignments that seem to be taking place.*|%%

Small smiles can now be seen on the faces of diamantaires across the world. %%

The reason – there are signs of the beginning of a recovery, although a slow one. After enduring a dull and dismal 2009, a more positive story seems to be unfolding, going by the figures for the first half of 2010 released by different manufacturing and trading centres round the world. India’s polished exports were xxx% up by value compared to the first six months of 2009, while Israel saw a surge of 91.7 per cent and Belgium reported a rise of 32.2 per cent in their respective polished exports as well. %%

No doubt rising prices and currency fluctuations have played their part, and the figures may not be as bright when looked at in volume terms. Thus, while India exported xxx mn carats polished, up xxx per cent from 2009, Israel registered a 63 per cent increase to 1.6 mn carats and Belgium managed a 2.5 per cent rise from the same period of 2009 to 3.63 million carats. Though slower than the increase in value terms, this still represents a growth of sorts, however. Of course, a comparison with 2008 figures provides some additional insights that shall be discussed subsequently. %%

News on the mining front was also more positive than the previous year. Analysts estimate that at the end of the June sight, total DTC sales in the first six months of 2010 at US$ 2.5 billion, were about 80 per cent above the levels of 2009. Preliminary reports also indicate that Alrosa clocked US$ 1.9 billion worth of diamond sales for the first half of 2010, up almost 50 per cent over 2009. Rio Tinto’s diamond production in the first half of the year totaled 7.1 million carats, up 5 per cent from the first half of 2009.%%

So even though the major markets in the US, Europe and Japan are still looking weak, the process of restocking that has begun there coupled with stronger growth in India and China, has seen some momentum returning to the trade.

While addressing delegates at the World Diamond Congress in Moscow in mid-July, WFDB President Avi Paz summed up the situation thus, “Fortunately, in the past few months we are witnessing signs of recovery and return to gradual growth.â€%%

Similar sentiments are voiced by people in different countries and various stages of the pipeline. "2010 continues to shape up well for Rio Tinto and we are driving our operations at close to capacity," says Tom Albanese, Chief Executive Officer. "Markets for most of our products are strong and the overall long-term demand outlook is positive."%%

Moti Ganz, Chairman of the Israel Diamond Institute Group of Companies (IDI), said that he was pleased with the recovery shown by the figures. “We are not surprised by the statistics, since the Israeli Diamond Industry is experiencing a pronounced upturn in activity. We are confident that the Israeli industry will continue to grow. We look forward to a return to our previous levels of activity,†he said.%%

Vasant Mehta, Chairman, GJEPC, believes that there is a slow revival of demand in the consuming countries. He says, “Overall situation in the in the world is that people are cautious but are coming back to the stores. The market however is still slow overall.â€%%

Echoing this is Nishit Parikh, newly elected President of AWDC. Parkh believes, “Everything looks good, but the world market is still fragile. A new economic downturn somewhere could affect the diamond industry, alongside other industries. The Antwerp diamond companies are doing business again, and have proven to be stable and solid. Nevertheless, financial stability is of utmost importance, and the market must be very careful not to overheat.â€%%

During his address to the World Diamond Congress, Ganz, who is also President IDMA, noted, “The industry is currently at a crossroads. But it has the power to make the post-crisis situation a defining moment in the diamond industry's history.â€

{{Demand: Revival is Slow }}%%

One key defining factor in the new direction for the industry will be the changes in demand patterns. Already, the strong performance of the newer markets has been one of the causes for hope. Meanwhile in the short run, some revival has been fuelled by the US market. During January – May 2010, net polished imports totalled $1.96 billlion, compared with $1.15 billion one year ago.%%

A closer look however reveals that this improved movement of goods, and the revival in manufacturing and trading is not firmly based on a long term revival in demand.%%

In terms of key markets, the world’s largest diamond consumer market is still the United States accounting for over 40 per cent of the global diamond demand with Europe adding another 14 per cent. These two markets have been severely hit by the financial crisis, the US from late 2008 onwards while Europe has seen some of its worst problems earlier this year.%%

While an estimated 20 per cent retailers have closed down over a span of 15 months, there is general agreement with an opinion voiced by Sean Cohen of Codiam International that “2010 is better than 2009 for sureâ€.%%

But this is only a relative assessment, things are nowhere near the levels of 2008, and many analysts believe that demand is going to be slow for a long time to come.%%

GJEPC’s Mehta observes that most Americans are now only purchasing for basic needs. “Bridal demand remains, but buying a second piece is being curbed or deferred.†%%

Taking a longer term view, Parikh of AWDC believes that there may be “an annual jewellery sales growth of 4-5 percent over the next decade which will be fuelled by bridal demand, some expansion of the market, an increase in life cycle milestones, more female self-purchasers etc.â€%%

In the shorter term however, demand is going to be mainly fuelled by restocking of inventory, and with extreme caution (see Accompanying story ….. US Market at the end).

Analysts indicate that there has also been a huge drop in consumer demand due to the withdrawal of ‘aspirational’ shoppers who were earlier willing to spend future income on current luxuries. Though luxury spending is up 14.3 per cent compared to a year ago, according to SpendingPulse, which comes from MasterCard Advisors and includes estimates for U.S. sales across all payment forms, this has to be seen in context -- spending at the highest-end department stores, restaurants, grocery stores and leather goods stores fell 2.9 percent in 2008 and 8.2 percent in 2009.%%

As Ganz puts it, “The facts on the ground show that the US market is reducing its market share in polished diamond sales, though it is still leading. The demand in the United States is on the decline in terms of quality, as well. The current focus is on lower quality and lower prices, at a time when many in the industry would like to see the market return to consuming high-quality goods.†%%

Both Europe and Japan are also grappling with the effects of the slowdown. A special crisis management plan helped weather the immediate storm in Greece, but the shadow of recession still looms over large parts of Europe%%

William Susman, chief operating officer of boutique investment bank Financo Inc. says, "What the economies throughout Europe are going to go through in the next six to 18 months, I think, will be dramatic," he said. "It will impact France, Germany and the northern Scandinavian countries as well. So I don't think that that story is over yet."%%

In Japan, while there are some weak indicators to suggest that the worst may be over (Japanese wage earners' total cash earnings rose the most in 4- years in April, climbing 1.5 percent from a year earlier and Consumer confidence has also crept back to the highest levels seen since October 2007), this Is not necessarily an indication of any immediate positive growth. U.S. Management consultants Bain & Company excluded the Far East market from their prediction of a 4 per cent growth in the luxury market for 2010. There they see a 3 per cent fall in luxury sales, following the 10 per cent drop in 2009. McKinsey & Company reported luxury sales were down about 5 to 6 percent for the first quarter.%%

Significant for the diamond industry is the fact that while specialty stores in Japan increased their sales by 2 per cent year-on-year over 2009, the story from jewellery stores where sales decreased 11.2 per cent was quite different.

It is only India and China, among the bigger markets where there has been some indication of steady growth in diamond demand. De Beers estimates that China’s share of the diamond jewellery market should double to 16 per cent by 2016. While no clear projections exist for the Indian market, various estimates believe that the market will continue to display double digit growth over the next few years and continue to be the third largest consumer of diamond jewellery. It is believed that over the next 5-6 years, with the decline in the US, and growth in these two new markets, India and China together will have as big a market share as the US itself. But that is still some way into the future.%%

Parikh summarizes the market scenario thus, “We are facing two realities: 1) a stagnating economy in the US, Europe and Japan and 2) an economy which is not affected by the notion of ‘crisis’, in the Far East. There is no doubt that in the coming years, India and China will fuel the global diamond trade.â€%%

{{Supply: Shortages Persist}}%%

On the supply side too, though figures for 2010 as discussed earlier, are in positive territory, this is relative to a period in 2009 that saw mining activity virtually grind to a halt.%%

“The current demand for rough diamonds exceeds the supply and there is a growing shortage of certain articles that are in high demand,†Ganz stated in his address at IDMA. “Today there are no inventories with the producers; they are selling current production immediately.â€%%

Giving a quick recap of the mining scenario over the last 18 months, Praveenshankar Pandya, Chairman, Diamond India Ltd (DIL) says that during the worst period demand for rough fell due to lack of movement in polished and the liquidity crunch. As a result rough prices dropped by about 30 per cent, there was little availability and direct customers of miners were the only ones with some goods. By mid 2009 there was a recovery as the pipeline cleared to an extent, demand for rough shot up and prices jumped. However over the next few months some equilibrium was reached. %%

While some short term price spikes may continue, GJEPC chairman Vasant Mehta believes that manufacturers are now more cautious. “While there is little rough being chased by many, profit margins are currently under pressure and manufacturers are cautious. Unlike in the pre-recession times, manufacturers have now sent out a clear message – rough will no longer be picked up at unrealistic prices.â€%%

In fact the WFDB/IDMA have sent a clear message to the miners, calling on them to “allocate sizable volumes of merchandise for sale outside of the tender systemâ€. They opined that tenders not only place smaller and medium manufacturers at a disadvantage, but also prevents “members of the diamond sector (from) implement(ing) any long-term strategic planning, including manufacturing and marketing programmesâ€.%%

Interestingly it also called for “increased co-operation with banks financing the diamond industry, so that credit will be available to all sectors of the industry as the diamond market enters a new growth phaseâ€.%%

In the long term most miners are of the view that supply will continue to be limited by the new economic realities. There are question marks over how much more supply can be expected from the existing mines, expectations from Canada are dramatically lower than what they were earlier, and there is no clear time frame over the underground development of the Argyle mine.

Gareth Penny recently told the media that diamond supply would decline in the future. "These great mines that were discovered 10, 20, 30 years ago are not being replaced today. According to the data that is out there, we're going to see some significant declines in diamonds."%%

The only area where rough seems to be more easily available – Zimbabwe – is shrouded in controversy, and while the agreement reached at the WDC meeting in St Petersburg provides some temporary relief, it is no more than that.%%

{{Concerns about profitability }}%%

Squeezed between the producers and the retailers, diamond manufacturers have seen severe declines in margins over the last decade, itself triggering off some changes. The recession on the one hand further speeded up this process, and on the other has seen the beginning of a shift that will significantly alter the relative balance between the three main centres --- Antwerp, Israel and India.%%

The squeeze on profitability is being raised at various levels. THE WFDB urged manufacturers to “internalize the lessons†of the crisis and “….(reduce) significantly the volume of goods being sold on consignment and also cut the standard periods for which terms of credit are extended.â€%%

At the IDMA meeting, Ganz was even more forthright. Noting that jewellery manufacturers, distributors and retailers have depleted their stock and are now in a replenishment mode, he called on manufacturers to be cautious in dealings with the retail sector.%%

“The current demand for rough diamonds exceeds the supply and there is a growing shortage of certain articles that are in high demand. Yet despite the shortage of rough, the polished retailers are still setting the terms of trade: they are dictating the prices, the periods of credit, the volumes they want on consignment,†he said. %%

{{Manufacturing Map: Signs of change}}%%

One important fall out of this period has been a subtle remapping of the manufacturing world. Analyst Chaim Evan Zohar earlier this year drew attention to the fact that India was the only one important centre that seemed to have weathered the storm in the financial markets. He noted that the India centre actually finished what many described as the worst year in the diamond industry’s history just a miniscule 1.7 per cent below its 2008 figures, while in carat terms exports were actually up 13 per cent.%%

India’s share of the US market rose from 20 per cent earlier in the decade to 25 per cent, while Israel’s fell from 53 per cent to 45 per cent and Antwerp’s share remained steady. He also noted a similar trend in the Japanese market.%%

Going forward, the picture at the end of the first half of 2010 has further confirmed this trend. India has surpassed its export levels of 2008, and Belgium is marginally behind, but Israel has seen some significant declines. In terms of the all important US market too, india’s share has continued to rise, and is now estimated to be nearly 30 per cent.

The Indian recovery too has been fairly swift and smooth. GJEPC’s Mehta and DIL’s Pandya estimate that while in its worst phase, manufacturing dropped to 50 per cent levels, today they are back at 75-80 per cent.%%

Industry sources believe that India’s share of the market in value terms has actually shot up from 60 per cent in 2008 to between 65-70 per cent post the recession. %%

How has this happened? They aver that between February and October 2009 when rough prices had declined significantly more than polished, the Indian industry took over a large bit of the ‘dossier’ business i.e. polished up to 0.99 pointers which are sold with dossiers rather than certificates. It is estimated that if before the crisis the ratio was 40:60 in Israel’s favour, today it has become 80:20 in India’s favour. %%

Sources indicate that this shift is also reflected in the manufacturing patterns in Surat – while about 30 per cent of smaller manufacturers have moved out of the business, through a process of consolidation many manufacturers have moved up the value chain in a major way doing better quality and larger goods larger goods in the 0.50 to 1.50 cts range.%%

{{Going Forward: Promotion is the Key}}%%

While these realignments are definitely good news for the India centre, the fact remains that there are still enormous challenges ahead. %%

Vasant Mehta quite frankly admits, “We are getting a beating from other product categories, and need to pay attention to promotions of the diamond jewellery category in a big way.†%%

Ganz described it saying, “Consumers can still buy three pieces of diamond jewellery for the price of one Louis Vuitton bag. The price of diamonds today should be at least 200 per cent more than their price in the 1990s. Just look where gold and platinum are and look where we are!"%%

IDMA noted that, "It seems that all parties that had been asked to support this important venture (IDB) understand the value of the creation of an entity that will advance generic diamond promotion and advertising projects in the global diamond jewellery consumer markets. IDMA sincerely hopes that the parties involved will make significant progress soon.â€%%

Mehta feels that taking ahead the International Diamond Board (IDB) initiative is “the need of the hourâ€. %%

“We must work towards increasing demand worldwide and should consider taking ahead the IDB initiative even if one or two stakeholders remain outside,†he concludes.

Table 1(India), 2(Antwerp) & 3(Israel)

|*There has been a pick-up in imports and exports across all the major centres during the first half of 2010. But the recovery from the dark days that began in the last quarter of 2008 is far from complete. Key markets are still reeling under the impact of the slump, and new emerging markets, though stronger, are small in absolute terms. $$

Amidst the beginnings of the recovery, one key aspect that is becoming clear is that the recession has speeded up a process of realignment, and that the contours of the diamond world that emerges will be somewhat different from the one that we knew till now.$$

{{Stephen Rego}} takes stock of the situation midway through what is going to be a critical year for the diamond industry, and maps some important realignments that seem to be taking place.*|%%

Small smiles can now be seen on the faces of diamantaires across the world. %%

The reason – there are signs of the beginning of a recovery, although a slow one. After enduring a dull and dismal 2009, a more positive story seems to be unfolding, going by the figures for the first half of 2010 released by different manufacturing and trading centres round the world. India’s polished exports were xxx% up by value compared to the first six months of 2009, while Israel saw a surge of 91.7 per cent and Belgium reported a rise of 32.2 per cent in their respective polished exports as well. %%

No doubt rising prices and currency fluctuations have played their part, and the figures may not be as bright when looked at in volume terms. Thus, while India exported xxx mn carats polished, up xxx per cent from 2009, Israel registered a 63 per cent increase to 1.6 mn carats and Belgium managed a 2.5 per cent rise from the same period of 2009 to 3.63 million carats. Though slower than the increase in value terms, this still represents a growth of sorts, however. Of course, a comparison with 2008 figures provides some additional insights that shall be discussed subsequently. %%

News on the mining front was also more positive than the previous year. Analysts estimate that at the end of the June sight, total DTC sales in the first six months of 2010 at US$ 2.5 billion, were about 80 per cent above the levels of 2009. Preliminary reports also indicate that Alrosa clocked US$ 1.9 billion worth of diamond sales for the first half of 2010, up almost 50 per cent over 2009. Rio Tinto’s diamond production in the first half of the year totaled 7.1 million carats, up 5 per cent from the first half of 2009.%%

So even though the major markets in the US, Europe and Japan are still looking weak, the process of restocking that has begun there coupled with stronger growth in India and China, has seen some momentum returning to the trade.

While addressing delegates at the World Diamond Congress in Moscow in mid-July, WFDB President Avi Paz summed up the situation thus, “Fortunately, in the past few months we are witnessing signs of recovery and return to gradual growth.â€%%

Similar sentiments are voiced by people in different countries and various stages of the pipeline. "2010 continues to shape up well for Rio Tinto and we are driving our operations at close to capacity," says Tom Albanese, Chief Executive Officer. "Markets for most of our products are strong and the overall long-term demand outlook is positive."%%

Moti Ganz, Chairman of the Israel Diamond Institute Group of Companies (IDI), said that he was pleased with the recovery shown by the figures. “We are not surprised by the statistics, since the Israeli Diamond Industry is experiencing a pronounced upturn in activity. We are confident that the Israeli industry will continue to grow. We look forward to a return to our previous levels of activity,†he said.%%

Vasant Mehta, Chairman, GJEPC, believes that there is a slow revival of demand in the consuming countries. He says, “Overall situation in the in the world is that people are cautious but are coming back to the stores. The market however is still slow overall.â€%%

Echoing this is Nishit Parikh, newly elected President of AWDC. Parkh believes, “Everything looks good, but the world market is still fragile. A new economic downturn somewhere could affect the diamond industry, alongside other industries. The Antwerp diamond companies are doing business again, and have proven to be stable and solid. Nevertheless, financial stability is of utmost importance, and the market must be very careful not to overheat.â€%%

During his address to the World Diamond Congress, Ganz, who is also President IDMA, noted, “The industry is currently at a crossroads. But it has the power to make the post-crisis situation a defining moment in the diamond industry's history.â€

{{Demand: Revival is Slow }}%%

One key defining factor in the new direction for the industry will be the changes in demand patterns. Already, the strong performance of the newer markets has been one of the causes for hope. Meanwhile in the short run, some revival has been fuelled by the US market. During January – May 2010, net polished imports totalled $1.96 billlion, compared with $1.15 billion one year ago.%%

A closer look however reveals that this improved movement of goods, and the revival in manufacturing and trading is not firmly based on a long term revival in demand.%%

In terms of key markets, the world’s largest diamond consumer market is still the United States accounting for over 40 per cent of the global diamond demand with Europe adding another 14 per cent. These two markets have been severely hit by the financial crisis, the US from late 2008 onwards while Europe has seen some of its worst problems earlier this year.%%

While an estimated 20 per cent retailers have closed down over a span of 15 months, there is general agreement with an opinion voiced by Sean Cohen of Codiam International that “2010 is better than 2009 for sureâ€.%%

But this is only a relative assessment, things are nowhere near the levels of 2008, and many analysts believe that demand is going to be slow for a long time to come.%%

GJEPC’s Mehta observes that most Americans are now only purchasing for basic needs. “Bridal demand remains, but buying a second piece is being curbed or deferred.†%%

Taking a longer term view, Parikh of AWDC believes that there may be “an annual jewellery sales growth of 4-5 percent over the next decade which will be fuelled by bridal demand, some expansion of the market, an increase in life cycle milestones, more female self-purchasers etc.â€%%

In the shorter term however, demand is going to be mainly fuelled by restocking of inventory, and with extreme caution (see Accompanying story ….. US Market at the end).

Analysts indicate that there has also been a huge drop in consumer demand due to the withdrawal of ‘aspirational’ shoppers who were earlier willing to spend future income on current luxuries. Though luxury spending is up 14.3 per cent compared to a year ago, according to SpendingPulse, which comes from MasterCard Advisors and includes estimates for U.S. sales across all payment forms, this has to be seen in context -- spending at the highest-end department stores, restaurants, grocery stores and leather goods stores fell 2.9 percent in 2008 and 8.2 percent in 2009.%%

As Ganz puts it, “The facts on the ground show that the US market is reducing its market share in polished diamond sales, though it is still leading. The demand in the United States is on the decline in terms of quality, as well. The current focus is on lower quality and lower prices, at a time when many in the industry would like to see the market return to consuming high-quality goods.†%%

Both Europe and Japan are also grappling with the effects of the slowdown. A special crisis management plan helped weather the immediate storm in Greece, but the shadow of recession still looms over large parts of Europe%%

William Susman, chief operating officer of boutique investment bank Financo Inc. says, "What the economies throughout Europe are going to go through in the next six to 18 months, I think, will be dramatic," he said. "It will impact France, Germany and the northern Scandinavian countries as well. So I don't think that that story is over yet."%%

In Japan, while there are some weak indicators to suggest that the worst may be over (Japanese wage earners' total cash earnings rose the most in 4- years in April, climbing 1.5 percent from a year earlier and Consumer confidence has also crept back to the highest levels seen since October 2007), this Is not necessarily an indication of any immediate positive growth. U.S. Management consultants Bain & Company excluded the Far East market from their prediction of a 4 per cent growth in the luxury market for 2010. There they see a 3 per cent fall in luxury sales, following the 10 per cent drop in 2009. McKinsey & Company reported luxury sales were down about 5 to 6 percent for the first quarter.%%

Significant for the diamond industry is the fact that while specialty stores in Japan increased their sales by 2 per cent year-on-year over 2009, the story from jewellery stores where sales decreased 11.2 per cent was quite different.

It is only India and China, among the bigger markets where there has been some indication of steady growth in diamond demand. De Beers estimates that China’s share of the diamond jewellery market should double to 16 per cent by 2016. While no clear projections exist for the Indian market, various estimates believe that the market will continue to display double digit growth over the next few years and continue to be the third largest consumer of diamond jewellery. It is believed that over the next 5-6 years, with the decline in the US, and growth in these two new markets, India and China together will have as big a market share as the US itself. But that is still some way into the future.%%

Parikh summarizes the market scenario thus, “We are facing two realities: 1) a stagnating economy in the US, Europe and Japan and 2) an economy which is not affected by the notion of ‘crisis’, in the Far East. There is no doubt that in the coming years, India and China will fuel the global diamond trade.â€%%

{{Supply: Shortages Persist}}%%

On the supply side too, though figures for 2010 as discussed earlier, are in positive territory, this is relative to a period in 2009 that saw mining activity virtually grind to a halt.%%

“The current demand for rough diamonds exceeds the supply and there is a growing shortage of certain articles that are in high demand,†Ganz stated in his address at IDMA. “Today there are no inventories with the producers; they are selling current production immediately.â€%%

Giving a quick recap of the mining scenario over the last 18 months, Praveenshankar Pandya, Chairman, Diamond India Ltd (DIL) says that during the worst period demand for rough fell due to lack of movement in polished and the liquidity crunch. As a result rough prices dropped by about 30 per cent, there was little availability and direct customers of miners were the only ones with some goods. By mid 2009 there was a recovery as the pipeline cleared to an extent, demand for rough shot up and prices jumped. However over the next few months some equilibrium was reached. %%

While some short term price spikes may continue, GJEPC chairman Vasant Mehta believes that manufacturers are now more cautious. “While there is little rough being chased by many, profit margins are currently under pressure and manufacturers are cautious. Unlike in the pre-recession times, manufacturers have now sent out a clear message – rough will no longer be picked up at unrealistic prices.â€%%

In fact the WFDB/IDMA have sent a clear message to the miners, calling on them to “allocate sizable volumes of merchandise for sale outside of the tender systemâ€. They opined that tenders not only place smaller and medium manufacturers at a disadvantage, but also prevents “members of the diamond sector (from) implement(ing) any long-term strategic planning, including manufacturing and marketing programmesâ€.%%

Interestingly it also called for “increased co-operation with banks financing the diamond industry, so that credit will be available to all sectors of the industry as the diamond market enters a new growth phaseâ€.%%

In the long term most miners are of the view that supply will continue to be limited by the new economic realities. There are question marks over how much more supply can be expected from the existing mines, expectations from Canada are dramatically lower than what they were earlier, and there is no clear time frame over the underground development of the Argyle mine.

Gareth Penny recently told the media that diamond supply would decline in the future. "These great mines that were discovered 10, 20, 30 years ago are not being replaced today. According to the data that is out there, we're going to see some significant declines in diamonds."%%

The only area where rough seems to be more easily available – Zimbabwe – is shrouded in controversy, and while the agreement reached at the WDC meeting in St Petersburg provides some temporary relief, it is no more than that.%%

{{Concerns about profitability }}%%

Squeezed between the producers and the retailers, diamond manufacturers have seen severe declines in margins over the last decade, itself triggering off some changes. The recession on the one hand further speeded up this process, and on the other has seen the beginning of a shift that will significantly alter the relative balance between the three main centres --- Antwerp, Israel and India.%%

The squeeze on profitability is being raised at various levels. THE WFDB urged manufacturers to “internalize the lessons†of the crisis and “….(reduce) significantly the volume of goods being sold on consignment and also cut the standard periods for which terms of credit are extended.â€%%

At the IDMA meeting, Ganz was even more forthright. Noting that jewellery manufacturers, distributors and retailers have depleted their stock and are now in a replenishment mode, he called on manufacturers to be cautious in dealings with the retail sector.%%

“The current demand for rough diamonds exceeds the supply and there is a growing shortage of certain articles that are in high demand. Yet despite the shortage of rough, the polished retailers are still setting the terms of trade: they are dictating the prices, the periods of credit, the volumes they want on consignment,†he said. %%

{{Manufacturing Map: Signs of change}}%%

One important fall out of this period has been a subtle remapping of the manufacturing world. Analyst Chaim Evan Zohar earlier this year drew attention to the fact that India was the only one important centre that seemed to have weathered the storm in the financial markets. He noted that the India centre actually finished what many described as the worst year in the diamond industry’s history just a miniscule 1.7 per cent below its 2008 figures, while in carat terms exports were actually up 13 per cent.%%

India’s share of the US market rose from 20 per cent earlier in the decade to 25 per cent, while Israel’s fell from 53 per cent to 45 per cent and Antwerp’s share remained steady. He also noted a similar trend in the Japanese market.%%

Going forward, the picture at the end of the first half of 2010 has further confirmed this trend. India has surpassed its export levels of 2008, and Belgium is marginally behind, but Israel has seen some significant declines. In terms of the all important US market too, india’s share has continued to rise, and is now estimated to be nearly 30 per cent.

The Indian recovery too has been fairly swift and smooth. GJEPC’s Mehta and DIL’s Pandya estimate that while in its worst phase, manufacturing dropped to 50 per cent levels, today they are back at 75-80 per cent.%%

Industry sources believe that India’s share of the market in value terms has actually shot up from 60 per cent in 2008 to between 65-70 per cent post the recession. %%

How has this happened? They aver that between February and October 2009 when rough prices had declined significantly more than polished, the Indian industry took over a large bit of the ‘dossier’ business i.e. polished up to 0.99 pointers which are sold with dossiers rather than certificates. It is estimated that if before the crisis the ratio was 40:60 in Israel’s favour, today it has become 80:20 in India’s favour. %%

Sources indicate that this shift is also reflected in the manufacturing patterns in Surat – while about 30 per cent of smaller manufacturers have moved out of the business, through a process of consolidation many manufacturers have moved up the value chain in a major way doing better quality and larger goods larger goods in the 0.50 to 1.50 cts range.%%

{{Going Forward: Promotion is the Key}}%%

While these realignments are definitely good news for the India centre, the fact remains that there are still enormous challenges ahead. %%

Vasant Mehta quite frankly admits, “We are getting a beating from other product categories, and need to pay attention to promotions of the diamond jewellery category in a big way.†%%

Ganz described it saying, “Consumers can still buy three pieces of diamond jewellery for the price of one Louis Vuitton bag. The price of diamonds today should be at least 200 per cent more than their price in the 1990s. Just look where gold and platinum are and look where we are!"%%

IDMA noted that, "It seems that all parties that had been asked to support this important venture (IDB) understand the value of the creation of an entity that will advance generic diamond promotion and advertising projects in the global diamond jewellery consumer markets. IDMA sincerely hopes that the parties involved will make significant progress soon.â€%%

Mehta feels that taking ahead the International Diamond Board (IDB) initiative is “the need of the hourâ€. %%

“We must work towards increasing demand worldwide and should consider taking ahead the IDB initiative even if one or two stakeholders remain outside,†he concludes.

Table 1(India), 2(Antwerp) & 3(Israel)

Be the first to comment