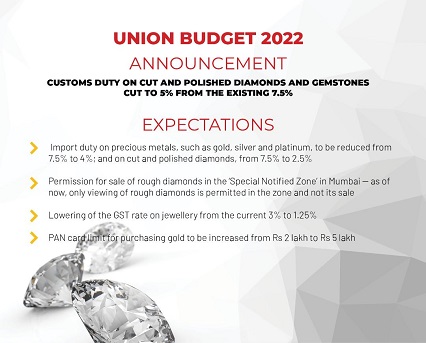

In her Budget speech, the Finance Minister said that customs duty on cut and polished diamonds and gemstones would be reduced to 5% from the existing 7.5%

The Gems and Jewellery industry has reason to be disappointed with the Budget announcements made by Finance Minister Nirmala Sitharaman a short while ago.

The Minister announced that customs duty on cut and polished diamonds and gemstones would be cut to 5% from the existing 7.5%.

This falls short of industry expectations, as industry bodies had asked for the import duty to be reduced to 2.5%.

In her Budget speech, Sitharaman said, “To give a boost to the Gems and Jewellery sector, Customes duty on cut and polished diamonds and gemstones is being reduced to 5%. Simply sawn diamonds would attract nil customs duty. To facilitate export of jewellery through e-commerce, a simplified regulatory framework shall be implemented by June this year. To disincentivize import of undervalued imitation jewellery, the customs duty on imitation jewellery is being prescribed in a manner that a duty of at least Rs 400 per kg is paid on its import.”

Industry reaction

Here is how a cross-section of industry leaders reacted to the announcements.

Ahammed MP, Malabar Gold & Diamonds.

The budget set a roadmap for a sustainable economic recovery banking on infrastructure development and agricultural reform. It has also proposed measures for comprehensive economic development across the region. All these measures will definitely boost consumer sentiment and will have a favourable impact on the organised jewellery retail. The customs duty cut on polished diamonds gemstones will boost diamond jewellery sales. Overall, it’s a budget which is firmly in the line of inclusive development.

Dr Saurabh Gadgil, Chairman and Managing Director, PNG Jewellers

The Budget has put a lot of emphasis on increasing exports across sectors and the same goes for Gems & Jewellery. India is a dominant player in the gems and jewellery sector in the world, and through the stimulus offered in this Budget, we are bound to increase our share. Simplified regulation for e-commerce exports in the G&J sector is a welcome move too. Duty reduction to 5% in cut/polished diamonds and gemstones is a good move. Increase in Capital expenditure by 4.1% is a boost to the overall economy. Overall, this Budget is growth-oriented and will lead to growth in our GDP.

Aditya Pethe, Director, WHP Jewellers

The budget is positive and growth-oriented. The government has focussed on infrastructure expenditure which will revive the Capital Expenditure. Given the current scenario, it will help revive the economy and generate employment. The reduction in Diamond is a welcome move. Apart from that there are no changes in individual taxation or any major announcement for the gems & jewellery industry.

Ishu Datwani, Founder, Anmol Jewellers

The one good aspect of this budget is the reduction of import duty on cut & polished diamonds and gemstones from 7.5% to 5%. Other demands of the jewellery sector have not been met. The budget seems growth-oriented and may give an impetus to the economy helping growth in GDP.

Vaibhav Saraf, Director, Aisshpra Gems & Jewels

The budget is focussed on infrastructure development. Increased capital expenditure and help to states for development will lead to higher fund infusion in the economy giving spurt to retail spending.A reduction in import duty on cut and polished diamonds to 5% will help in curtailing the high diamond prices to a certain extent.

Bhavik Chinai, BVC Logistics

Expansion of SEZ’s advantages to existing infra through new legislation is promising for the G&J sector. Alongside, the Customs National Portal with a promise to facilitate customs clearance digitally will reduce the transaction costs in jewelry exports by over 20%. The potential impact of such initiatives could be increase in diamond imports which would greatly benefit the Indian Markets. Budget 2022 has brought in quite a few positives for the logistics sector at large and even for the jewellery imports specifically.

Industry expectations

Here’s what the industry expectations were:

Be the first to comment