India’s economic slowdown which began before the lockdown of 2020, eventually brought the whole economy on its knees. Therefore this budget will have to be truly ground breaking in order to resurrect the Indian economy. Here’s what industry personnel expect of the Union Budget of 2021

The COVID-19 pandemic and consequent economic slowdown have set the G and J industry back by about two years, the last quarter of 2020 however has shown some green shoots. The industry still has a long way to go in terms of being really profitable like in the pre-Covid days. Budget 2021 will set the tone for this growth.

Union Budget for 2021-22 will have to focus on creation of jobs and bringing in real time demand for big ticket items. Purchasing capacity and willingness to spend on luxuries led by the G & J industry is something that can give a major push to India’s economic balance as well.

Says Ishu Datwani, Founder, ANMOL, “One of the few things that would be a part of my wish list is the reduction in the import duty on gold. Apart from that, I also hope to see some simplification of the paperwork and processes in all spheres, so that we can concentrate on increasing business and generate more employment. Thirdly, I wish to see some reduction in the taxes levied, so that people could have more money to spend, which in turn would give the economy the boost it needs.” This Mumbai-based jeweller has put down his wish list. All the same, different industry stalwarts have different wish-lists.

.jpg)

Where there is a will…

Government support is integral to any industry’s growth. Continued support from government is going to be vital. The government has to reduce duties on imports, because the duty imposed in India is among the highest in the world. It would be very beneficial if these rates were brought down considerably. Curbing malpractices in any industry needs to be the prime focus of the government in order to create a level playing field. It is upto the FM to now decide what how it can be done. Opines Rajesh Kalyanraman of Kalyan Jewellers, “We expect that the government reduces import duties and works towards bringing transparency in imports. It will be of great help to the industry and will ensure growth of the sector in the right way.” Reduction in import duty will provide a boost to imports and bring in gold from abroad by lawful means – this will help create a level playing field.

A challenging year ahead

The fiscal year 2020-2021 has been a big challenge for Indian Government. Covid-19 exposed the failing structure of our healthcare system and brought tax collection to a grinding halt.

Says Vaibhav Saraf, Director, Aisshpra Gems and Jewels, “With focus on increasing Digital Payments, improving internet connectivity and free Covid-19 vaccines, we don't expect a major relief in tax slabs for individuals or corporate in the upcoming budget. However, Government might increase spend towards improvement of public health facilities and infrastructure development, and this can increase liquidity in the markets which will boost manufacturing and retail sales alike.” The government will have to work towards creating ease of functioning for businesses in order to encourage entrepreneurial spirit among youngsters. This will usher in financial independence and usher newer opportunities for growth.

While Snehal Choksey, Director, Shobha Shringar Jewellers believes, “This is the budget after a long wave of the pandemic so I feel that there would not be any major change in the policies. The focus will be on the lower and middle strata of the society who will be given various Standard Operating Procedures which will affect them positively.”

G & J industry needs all the support possible

The PMLA blotch needs to be washed away, G & J industry comprises of honest businessmen who have been rendering exemplary services for generations and safeguarding some of the most precious assets of the country and contributing quite well to government coffers. Taking into account this fact, tarnishing the image of the industry by calling it a gateway for money laundering is truly unjust. At the same time, jewellery retailers will do their best to support the government in nabbing suspicious entities. All they need is the government’s trust and impetus to boost their trade.

.jpg)

“Government should support the G & J industry and should not implement PMLA the way many people thought they would. A little bit of lenience is required from the government towards the G & J industry as many small scale jewellers run their households on income generated through this business. The industry is already burdened with heavy taxation and a lot of restrictions,” explains Vikram Talwar, Talwarsons Jewellers.

At one point jewellers have come to a level where they are openly saying if the government does not give us more subsidies at least it should not increase our worries. No additional burden please: Says Sumeet Anand, Punjabi Saraf, Indore, “Government should not increase any taxes or duties imposed on the G & J business. They should also ease the PMLA norms imposed on jewellery sector. Jewellery retailers are already fulfilling customer KYC requirements for income tax. This additional regulation isn’t required.”

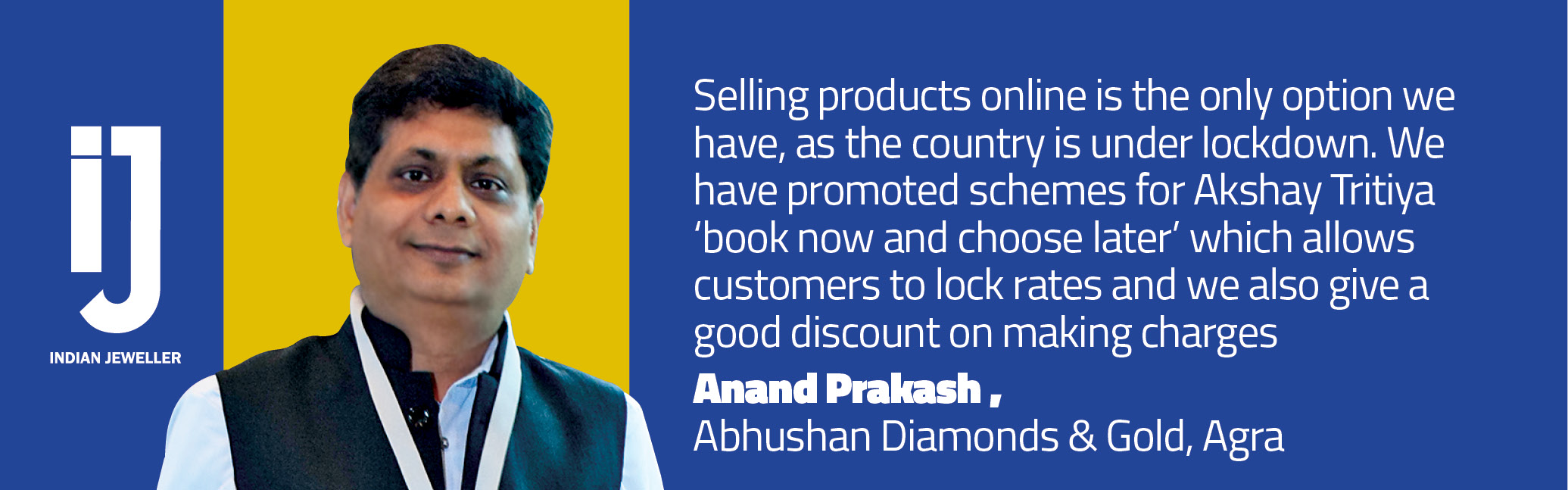

Creation of employment opportunities will prove to be crucial and the government must focus its energies towards this goal. According to Anand Prakash, Abhushan Jewellers, Agra, “Union Budget 2021 needs to focus on creating opportunities for growth across all sectors. Job cuts from across the world have put additional responsibility on the Indian government to create employment for the these people as well as the local youth.”

All in all, India needs a well-researched budget to get the flailing economy back on track.

Be the first to comment