Nirmala Sitharaman to form a Special Group to resolve all issues related to the gem and jewellery sector

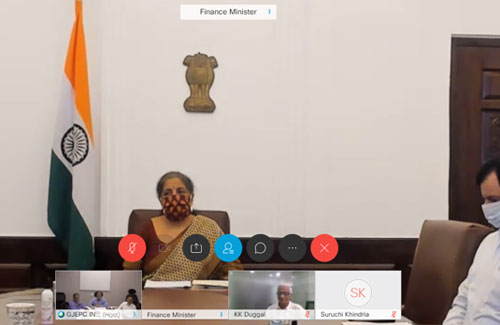

In a virtual review meeting held between the Finance Ministry and the GJEPC on 18th August, the Finance Minister Nirmala Sitharaman called for the formation of a Special Group, including Customs and banking officials, to resolve all issues related to the gem and jewellery sector.

The Finance Minister added that if the gem and jewellery industry does not get a satisfactory reply from the Special Group, the matter may be flagged to the FM.

The meeting was attended by Nirmala Sitharaman, Finance Minister; Sandeep Bhatnagar, Member Customs; G D Lohani, JS TRU; Colin Shah, Chairman, GJEPC; Vipul Shah, Vice Chairman, GJEPC; Sabyasachi Ray, Executive Director, GJEPC.

Expressing gratitude to the Finance Minister for the review meeting, Colin Shah, Chairman, GJEPC said, “The exports of gem and jewellery sector is witnessing some signs of recovery . We are hopeful that market will recover soon as exports to USA, Europe and China have commenced. We are thankful to Hon’ble Finance Minister for the special group formation under Member customs. This would help address the sectoral concerns and resolve trade related bottlenecks. It’s an important step towards attaining ease of doing business”.

The various issues represented by GJPEC during the last meeting included, Direct sale of rough in the SNZ, Mumbai by miners; Reduction of polished import duty from 7.5% to 2.5%; Clarification on Online Equalisation Levy for B2B International Diamond Auctions; Reverse Job work in SEZ; GST issues, etc.

With regards to Direct sale of rough in the Special Notified Zone in Mumbai by miners, the officials informed that the issue is under examination and in the upcoming budget there will be some provision in the Finance Act. Transfer Pricing Committee is examining the issue and will come up with some solution.

Colin Shah said, “Reverse Job work in SEZ is not allowed currently. The officials have assured that discussions are on between DoC and Dept of Revenue. A final view on this will be taken, as the Ministry is looking at a larger framework and assessing the Baba Kalyani report".

On clarification on Online Equalisation Levy for B2B International Diamond Auctions, JS TRU mentioned that EL applies to all the sales made through online platform, and at this point it is applicable to B2B transactions as well. The online transactions fall under the ambit of EL.

Sabyasachi Ray, ED, GJEPC requesting for a clarification said, “Since there is no import duty on the import of rough diamonds, the imposition of EL will hamper our industry, this will be the setback for the industry.”

With regards to RMS, Colin Shah pointed out that the goods less than US$ 50000 may not go for valuation and also goods coming for certifications may be exempted from valuation.

Be the first to comment