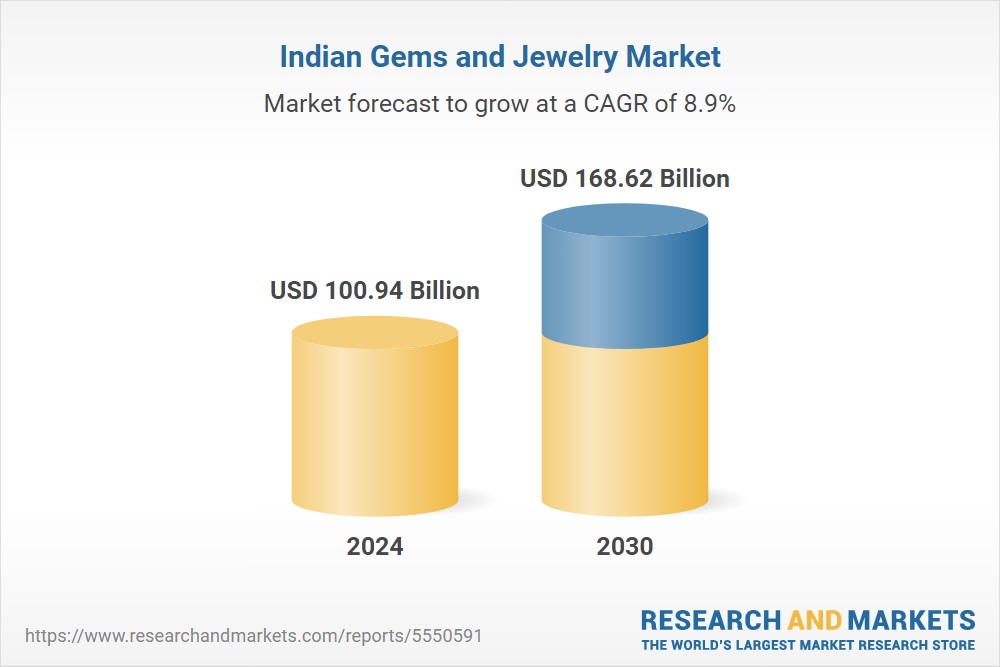

India’s gems and jewellery industry is on a strong growth trajectory, with the market projected to reach USD 168.62 billion by 2030, up from USD 100.94 billion in 2024, according to a new report by TechSci Research. Anchored in cultural tradition and fuelled by rising disposable incomes, the sector continues to thrive despite global headwinds

India’s gems and jewellery market is poised for robust growth, expected to surge from USD 100.94 billion in 2024 to USD 168.62 billion by 2030, clocking a compound annual growth rate (CAGR) of 8.9%, according to a new report by TechSci Research.

This growth is fuelled by the country’s cultural affinity for gold, diamonds, and precious gemstones—especially during weddings and festivals like Diwali and Akshaya Tritiya. The sector remains a critical pillar of the Indian economy, with deep roots in gold refining, diamond cutting, and handcrafted jewellery.

However, the market also faces challenges, including volatile global gold prices and rising input costs, which impact consumer purchasing power and margins for jewellers. India’s reliance on imported raw materials further adds to its vulnerability to global supply chain disruptions.

A notable trend reshaping the market is the rising demand for lightweight and daily-wear jewellery. Young consumers are increasingly opting for minimalist, affordable designs in 14K and 18K gold, along with smart jewellery that blends fashion and functionality.

Major players driving the industry include Titan Company, Kalyan Jewellers, Malabar Gold, Joyalukkas, Rajesh Exports, and PC Jeweller.

Be the first to comment