India's watches and jewellery market for the year 2024 is projected to be approximately $92.06 billion, with steady growth fuelled by demand for luxury items. High-end jewellery watches are seizing this moment, offering distinctive, heirloom-quality pieces that cater to consumers looking for both tradition and exclusivity

The watches and jewellery market in India is heading towards the $92.06 billion-mark, according to global data and business intelligence platform, Statista, which says the market will continue to grow at 6.05% annually through 2029. High-end timepieces are increasingly sought after by a rising middle class eager for items that symbolize exclusivity and luxury. With brands such as Jaipur Watch Company, Binny’s Jewellery, Marcks & Co., and Enshine, India is crafting a unique narrative in the global luxury watch market.

A Niche Market with Growing Demand

High jewellery watches are finding favour with discerning buyers, though the market remains challenging. Anil Patel, Founder, Enshine, Surat, explains, “The machinery and R&D required for such watches are costly, and India’s market has not fully matured to match global players like Bulgari." Nonetheless, demand is rising. Patel highlights that luxury watches are increasingly appreciated, especially in view of high-profile events such as the Ambani wedding, where luxury watches were given as gifts to guests.

Sneh Patel, Binny’s Jewellery, Mumbai, acknowledges the complexities in positioning these watches as high jewellery pieces. "The challenge lies in presenting them as both high jewellery and functional timepieces. But interest is growing, with watches becoming a central part of our broader luxury offerings."

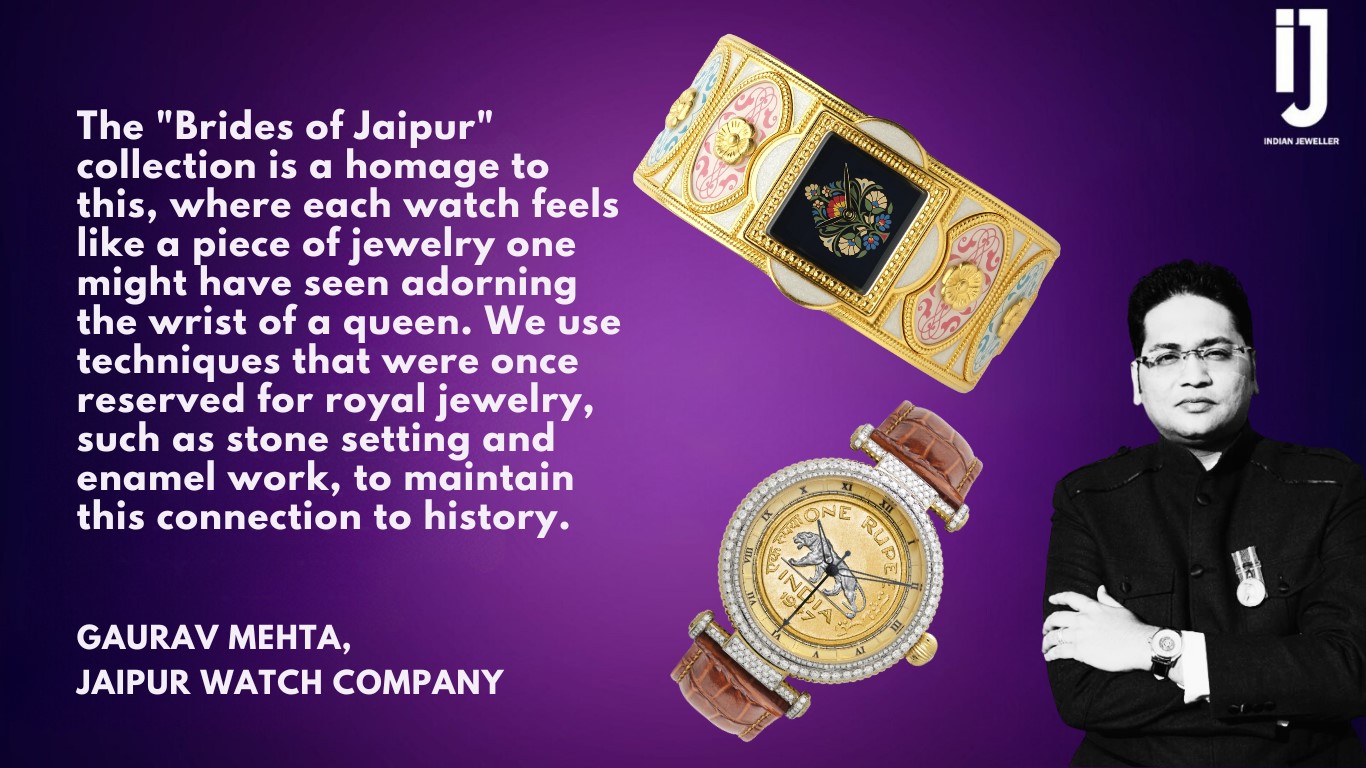

Many Indian brands are reviving traditional artistry through their watchmaking. Jaipur Watch Company exemplifies this, with collections rooted in cultural heritage. Gaurav Mehta, founder of Jaipur Watch Company, Jaipur, explains, "Our ‘Brides of Jaipur’ collection merges intricate craftsmanship with watch design, with our products appealing to those who appreciate heritage and art." These timepieces bring the essence of Rajasthan’s regal legacy to life through thoughtful design and meticulous detail.

Meanwhile, Binny’s Jewellery focuses on customization, ensuring each high jewellery watch reflects the unique personality of its wearer. By blending tradition with contemporary design, its bespoke pieces cater to modern luxury-seekers looking for meaningful, personalised accessories.

Marcks & Co., on the other hand, has revived its legacy by transforming its archives of royal-era pocket watches into modern timepieces. This revival appeals to collectors seeking watches that capture the grandeur of India’s heritage, and reflect its artistic legacy.

Redefining Luxury in India’s Evolving Market

India’s luxury watch market is expanding, and a shift is underway as consumers begin valuing Made-in-India products alongside Swiss brands. "In India, demand for luxury watches is rising. Even with long wait times for brands such as Rolex, buyers are willing to invest in these high-value timepieces,” says Patel.

This shift is redefining luxury for the younger generation. Young buyers are drawn to bespoke, story-driven designs, and brands such as Binny’s Jewellery meet this demand with personalised services. "Each piece we create reflects the client’s vision, ensuring it becomes a cherished heirloom," says Patel (Sneh).

The path to producing high jewellery watches is not without obstacles. "The machinery required can cost upwards of Rs 2.5 crore," says Patel (Anil), explaining that Indian brands must find innovative ways to meet these challenges. "If we can’t use the same equipment as global brands, we conduct R&D to develop alternatives. This allows us to maintain quality, while building trust among Indian buyers,” he adds. While international buyers recognize the value of these luxury pieces, awareness is still growing in India. In 2023, Knight Frank’s report ranked luxury watches as the top investment for India’s ultra-wealthy, surpassing even fine art. Younger consumers are also driving demand, as per a Deloitte survey on discretionary spending. About 60% of Indian consumers now buy luxury goods annually, and for watches, brand image reigns supreme; 64% of Indian buyers prioritize brand prestige over price, in contrast to global trends. In fact, this is why Swiss brands such as Rolex and Patek Philippe are gaining a strong foothold in India's booming $7-billion luxury watch market. Patel (Anil) notes that the increasing popularity of high-end brands is a reflection of the changing mindset of the Indian consumer, whose appreciation of luxury is growing rapidly.

From Luxury to Legacy

In the context of luxury watches, particularly high jewellery timepieces, the appeal lies not only in their aesthetic and functional qualities, but also in their ability to carry forward a legacy, much like traditional heirloom jewellery. These watches merge heritage and innovation, adding a timeless quality that many affluent buyers find appealing.

"These pieces will gain value over time," says Patel (Sneh), adding, "Just like traditional jewellery, high jewellery watches carry a legacy." This idea of legacy is central to Indian watchmakers, he points out, explaining why Jaipur Watch Company offers bespoke services, incorporating personal elements such as family crests into its designs. As India’s luxury market expands, these timepieces are becoming essential elements of high-end collections, resonating with buyers who value both the status and intimate storytelling potential inherent in each piece.

Written by Dhwani Rathod and Riddhi Oza

Be the first to comment